Cashless and Contactless Payment Apps to Use in the New Normal

The ongoing coronavirus pandemic has made people resort to digital means in doing almost everything—working, learning, shopping, and banking—in the efforts to stay home and prevent exposure to the virus outside. With just your mobile phones or laptops and the internet, you can accomplish your tasks online without the hassle of falling in line and risking your safety.

Money transfers, bills payment, and more can be done now with cashless and contactless payment applications that can be easily installed on your phones. As we gear up to face life post-COVID-19, this might be very well the new norm when it comes to payments. In fact, Mastercard has conducted a survey in the Philippines last April, which showed that Filipino consumers are now using contactless payments more often in light of the COVID-19 pandemic.

To get you started, we’ve listed below cashless payment methods currently available for you to start using!

Mobile banking apps

Mobile banking surely changed the way people do their bank transactions. Now, a person can do multiple transactions like balance inquiry, money transfer, and bills payment using just a mobile app. According to online finance platform Moneymax, mobile banking is becoming a vital part of the finance industry and is predicted to slowly take over traditional banking transactions. With that, here is a quick rundown of mobile banking applications from the country’s top banks.

Mobile and e-wallets

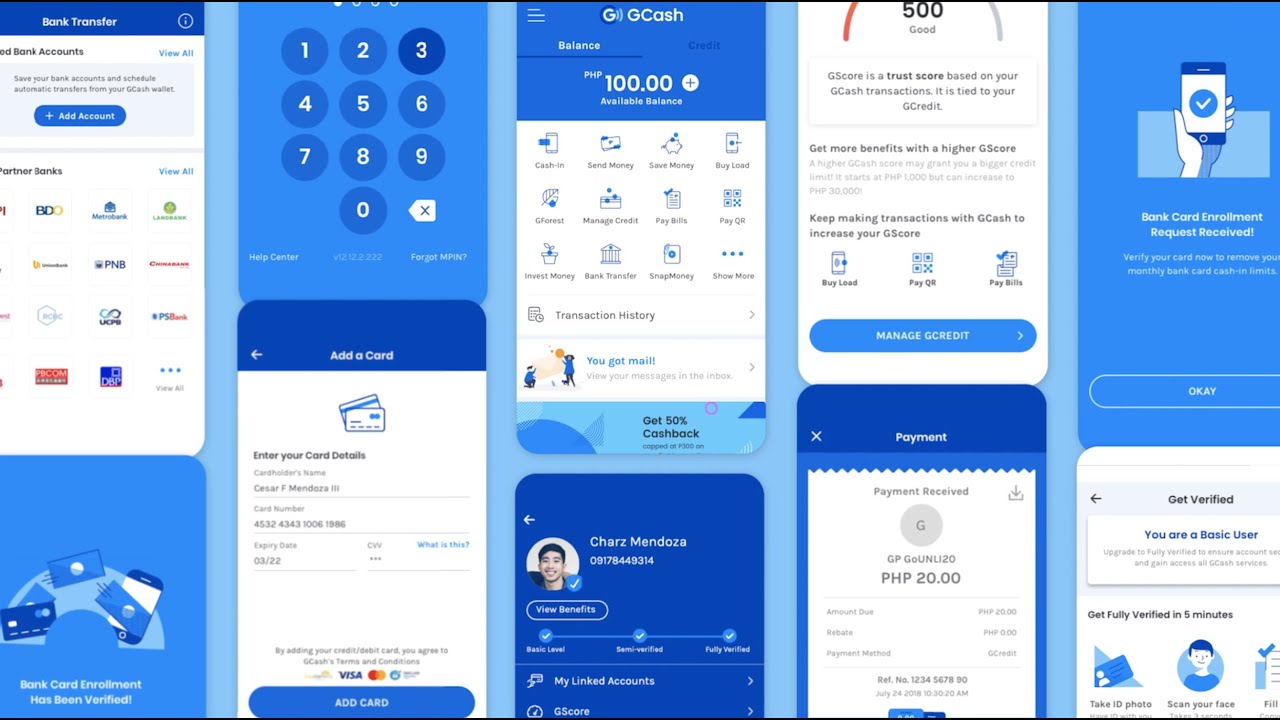

GCash

From Globe Telecom comes this mobile wallet and micropayment service to send and receive money, pay bills, and shop online with GCash American Express Virtual Pay. Users get to enjoy a rebate, perks, and easier loading and bill payments just by simply linking the app to their mobile number.

Available in the App Store and Google Play.

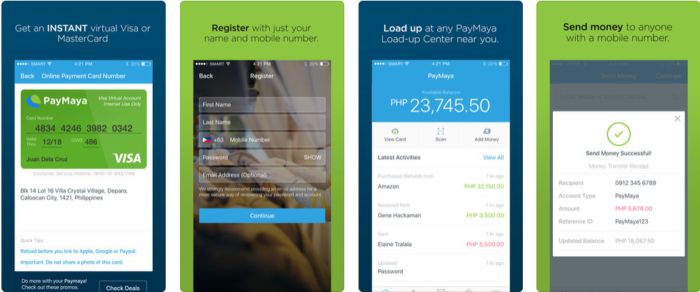

PayMaya

PayMaya works like a virtual prepaid debit card loaded through convenience stores, malls, and mobile bank transfer. Use the app to pay for a wide selection of retailers by simply scanning the cashier’s QR code. The company also recently promoted that PayMaya is an option even for street vendors and sari-sari stores.

The app is available in both the App Store and Google Play.

GrabPay

GrabPay is an e-wallet available within the Grab app, which you can use to pay for their services like GrabExpress, GrabFood, and GrabCar as well as other transactions like hotel bookings, bills payment, and load purchases. QR codes are mainly used to make a purchase to merchants and establishments that accept GrabPay as a mode of payment.

Download the Grab app from the App Store and Google Play.

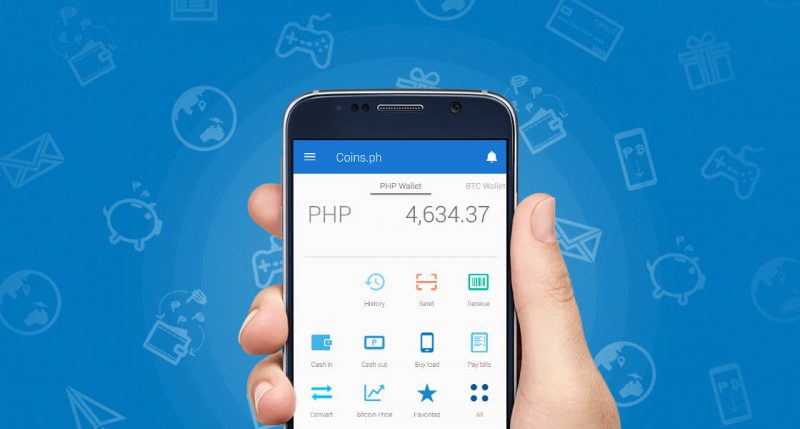

Coins.Ph

The company is one of the few that accept bitcoin transactions. The app does not require a bank account and is licensed by the Bangko Sentral ng Pilipinas to offer electronic money, remittances, and virtual currency and exchange services.

Available in the App Store and Google Play.

With the current situation, it is easy to expect more financial technology companies to open shop in the country in the years to come especially. The current companies are also hard at work to fully secure their systems and client information. Start to switch now to cashless for faster, safer transactions in the new normal!

Also read: 5 Handy Online Payment Partners for Your Convenience

Sources: Coins.ph, GCash, PayMaya, Grab