From BRICs to VIPPs: A new way of looking at prosperity

The Philippines was recently ranked as the 60th most prosperous country in the world out of 149 by the Legatum Institute. It is a fantastic achievement for a country that has defied the global economic trend, withstanding pitfalls in the United States and European markets.

A NEW WAY OF LOOKING AT PROSPERITY. Gone are the days when economic potential was the only way of looking at how prosperous a country is (and can be). Image grabbed from Legatum Institute on Twitter

However, the same study also told us one other thing: prosperity does not necessarily follow a global economic trend. Good economic policies will never be enough to call a country “prosperous”, as shown in the current states of BRICs, an acronym that popped up in 2001. The 2016 study just introduced a new acronym that has more potential in driving global prosperity: VIPPs.

But what are these two acronyms, and how are they linked?

BRICs

BRICS. Until 2010, it stood for 4 countries. Nowadays, it stands for five, including South Africa. Image grabbed from Pixabay

Back in 2001, Jim O’Neill, who was then the chief economist for Goldman Sachs Asset Management, coined the term “BRICs”. It’s an acronym for Brazil, Russia, India, and China, four countries which, according to O’Neill, would be the biggest contributors to global economic growth, next to G7 (United States, Canada, France, Germany, Italy, Japan, and the United Kingdom).

They were seen as potential key players in the next 5 decades, and were expected to become part of the group of countries (known today as G7) that would play a vital role in global economic policy coordination.

However, among the 4 BRICs, only two have stood the test of time. China and India now account for at least a quarter of the world’s economic output, while Russia and Brazil have continued to plummet due to economic and political unrest. At one point, they were deemed as countries with the highest potential, but Brazil and Russia lacked other key factors that drive prosperity: Education, Governance, and Social Capital.

Governance ranking for Brazil dropped from 63rd to 74th, while Russia sits at 108th. It’s an improvement for Russia, but it’s below the standard given to them by O’Neill. Brazil may still be in the top 50, but it still remains below par in terms of their economic growth as it is hindered by widespread corruption.

NOTE: BRICS today stands for Brazil, Russia, India, China, and South Africa. South Africa was a recent inclusion (2010) to the list of major developing countries.

VIPPs

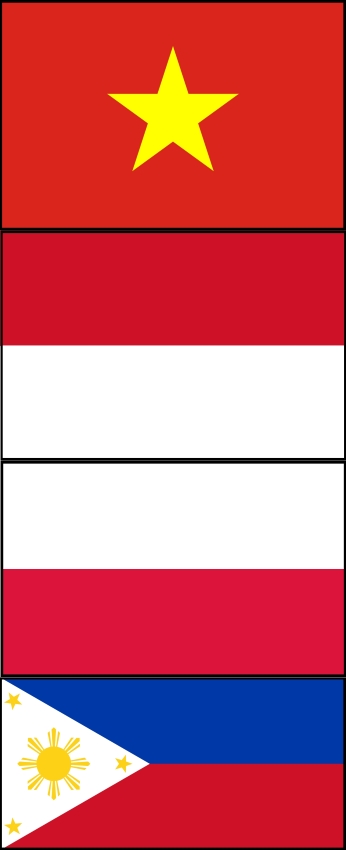

A NEW WORLD ORDER? VIPPs, a term coined by the Legatum Institute, may soon become the go-to for countries looking to improve on prosperity growth rates. All flags grabbed from Wikimedia Commons (The Philippines, Poland, Indonesia, Vietnam)

If BRICs were debunked thanks to two underperforming countries, where will people look to get an insight on prosperity? Enter the VIPPs.

VIPPs, a term coined by the Legatum Institute, stands for Vietnam, Indonesia, Poland, and the Philippines. These countries showed the most promise for prosperity in the recent Legatum Prosperity Index, especially in the factors that Brazil and Russia failed in: Education, Governance, and Social Capital. Each country is above global median scores in Governance, Education, and Social Capital, three of the main drivers for prosperity.

They also have populations large enough to make a substantial contribution to global prosperity, with Indonesia and the Philippines already breaking the 100-million population mark (Indonesia at approximately 157.6 million, and the Philippines at 100.7 million).

Each country has seen faster prosperity growth rates than the world average, ranging from as low as 5% to as high as 7% (the global average is 3%). The fact that they have solid foundations in governance, education, and social capital means they can sustain that growth for years to come.

Vietnam, for one, may not be a democratic government, but it does have “reasonably effective governance”. Poland may fall below the global median in Social Capital, but only because its population is significantly lower compared to others in VIPPs at roughly 38 million.

Why VIPPs, then?

Why the focus on VIPPs from the Legatum Institute? VIPPS have the makings of drivers for global prosperity thanks to their large populations and positive prosperity growth trends. They are looked at as a better set of performers than the BRICs (except China and India), having the potential to make significant contributions to global prosperity within the next decade thanks to their stable foundations.

If you’re a businessman looking to make his/her mark on the world, and you happen to own a multinational company, pay close attention to VIPPs. If the folks at the Legatum Institute have properly done their homework (and they’ve done so for the past 10 years), any investments made within the VIPPs will be worthwhile.

Source: Prosperity.com, Legatum Institute