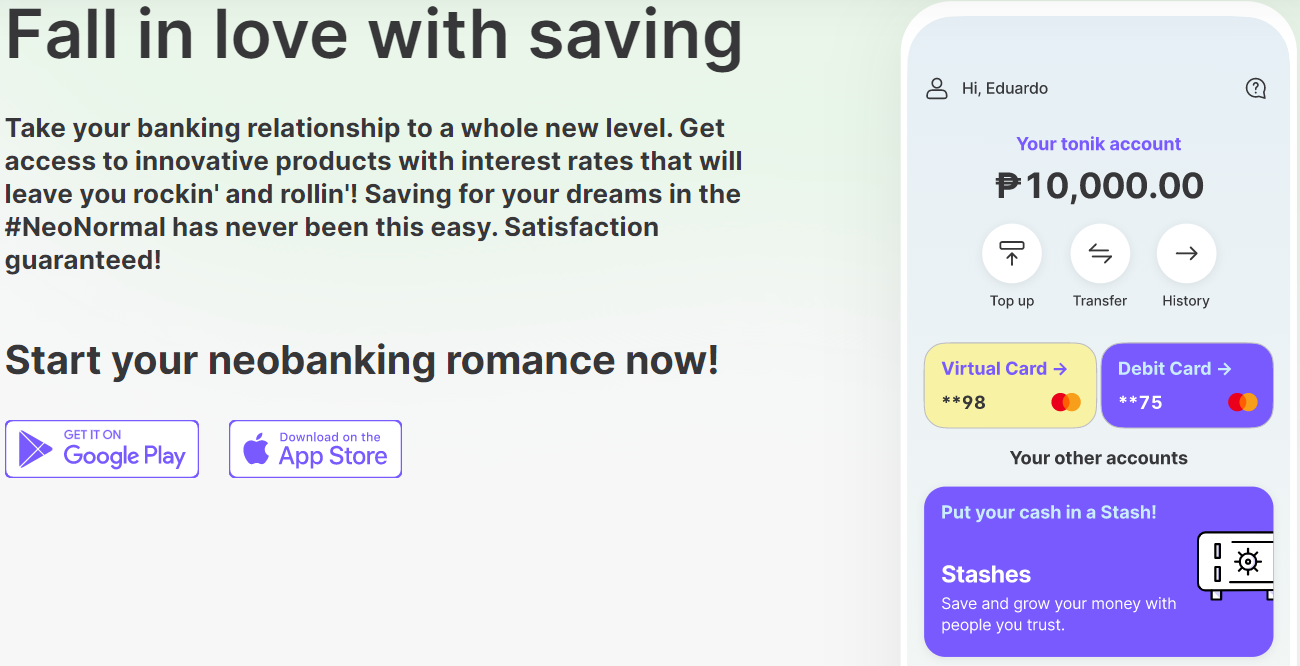

Digital Bank Tonik Goes Live In PH, Offers High Interest Rates

Tonik Digital Bank Inc. officially launched in the country on Wednesday, March 18.

SCREENSHOT from Tonik’s website

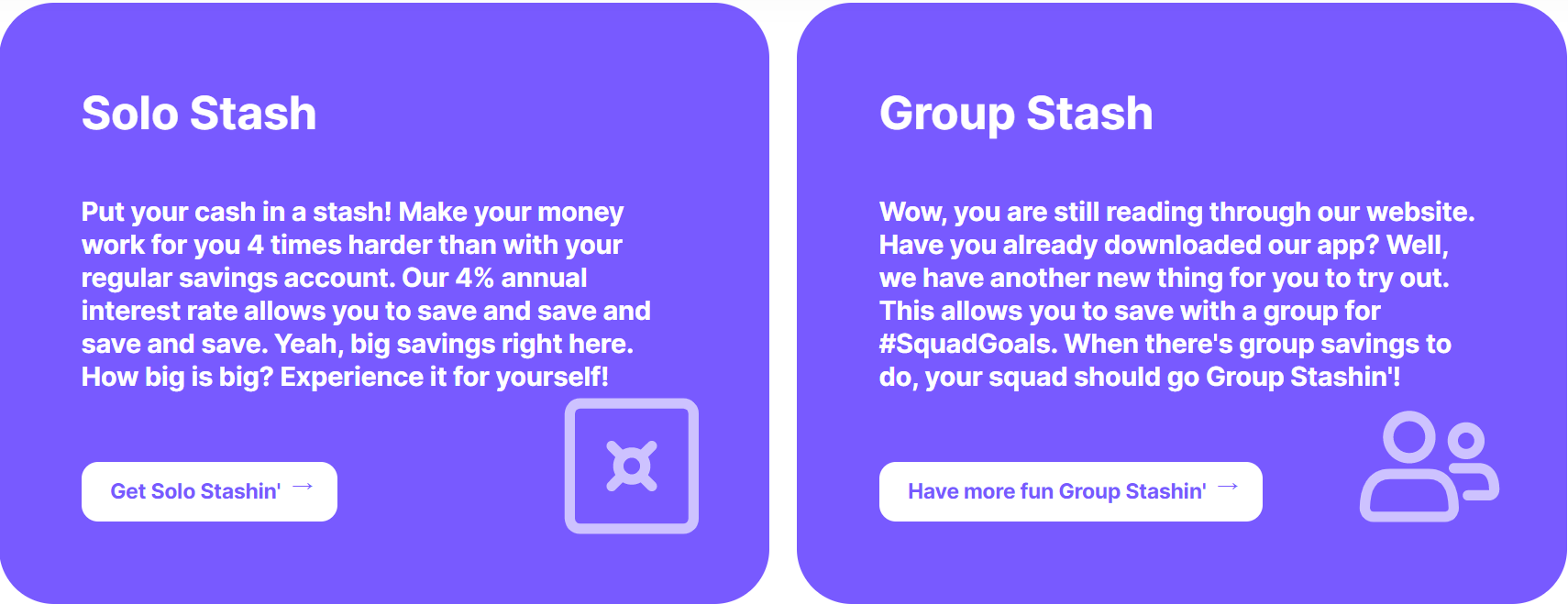

SCREENSHOT from Tonik’s website

During its media launch, Tonik founder and CEO Greg Krasnov said they’re aiming to drive financial inclusion in the Philippine market by simplifying the banking experience, which many people find intimidating.

“By being more technology-driven, we’re aiming to make the people’s financial management quite simpler and less intimidating, which they are used to [experience] from the banks. You can start your journey with us with just a few clicks of a button: no fuss, no hassle. You don’t need to go to any branch. You can do it at the comforts of your own home or office,” he said.

Tonik does traditional banking transactions online such as deposits, payments, and loans through its mobile banking app, giving its customers the opportunity to enjoy a fully digital banking experience.

“It’s all digital. We actually do everything on the cloud. People want to stay at home because they want to [feel] safe. With Tonik, you won’t have to line up in the banks. You can do transactions anytime, anywhere because we do know that people need access to their money 24/7,” said Ed Joson, Tonik Philippines chief product officer.

He also said they’re offering up to 4.5% and 6% interest rates per annum for savings account and time deposit respectively, one of the highest in the country.

“You always need to be smart when it comes to your future. You can’t just stop at putting your money in a savings account. You have to put it somewhere it will actually grow,” he added.

When asked how Tonik is going sustain its high interest rates, Chief Growth Hacker Mila Bedrenets explained that since they run most of their operations online, they don’t have to invest in any physical branch and other resources. Hence, the dramatically reduced operating cost enables the company to offer very good interest rates.

SCREENSHOT from Tonik’s website

SCREENSHOT from Tonik’s website

Tonik also offers the “solo stash” and “group stash” savings features which encourage customers to save money for a specific investment or goal. Through this, customers can categorize their savings into up to 5 categories with 4.5% interest rate.

Bedrenets said they took the inspiration from pahulugan, a pool saving system unique to Filipinos, wherein you save together with a group of friends and take turns collecting the accumulated funds on a set date, and modernized it to make it more accessible and convenient to users.

You can download its mobile app on Google Play Store and App Store.

Tonik is supervised by the Bangko Sentral ng Pilipinas, while its deposits are insured by the Philippine Deposit Insurance Corp.