GUIDE: An Introduction to Cashless Transactions & Online Banking in the Philippines

There was a time when Filipinos mainly relied on cash for transactions, but with the rise of e-commerce, digital payments have become the new norm. As online shopping continues to grow, more and more Filipinos are embracing the convenience and security of digital and cashless transactions for their purchases.

To further highlight this growing trend, we are introducing you to the most popular and convenient digital, cashless methods used by consumers in the Philippines today.

Bank Transfers

IMAGE from Pexels

IMAGE from Pexels

Primarily used by Filipinos working abroad, money transfer is the act of wiring money from one place to another. It can be done electronically and physically and comes in various forms such as:

- Money order: Making payments using a document such as a postal check. A payment guarantee from the sender is needed before a money order is released.

- Electronic funds transfer: Transferring money from one bank account to another.

- Wire transfer: An electronic transfer of money from one bank to another via a network.

BSP National QR Code Standard

IMAGE from Pexels

IMAGE from Pexels

Quick response (QR) codes have become a popular e-payment method over the past few years. Because of this, the Bangko Sentral ng Pilipinas (BSP), launched the QR PH person-to-merchant payment facility. This is an electronic payment system that allows buyers to pay even small value transactions such as jeepney or tricycle fares and payments of goods and services to micro, small, and medium enterprises at no cost to the buyer.

What sets this apart from traditional debit and credit cards is that it’s contactless, which proved to be particularly advantageous during the COVID-19 pandemic. Ultimately, it aims to create interoperable payment solutions so that both buyers and sellers won’t have to open accounts with various providers. Merchants can accept digital payments from customers using any bank or e-wallet app without having to use multiple QR codes or integrate with many devices and systems.

E-wallets

IMAGE from Pexels

IMAGE from Pexels

Lining up to pay for our purchases or bills using cash can be quite a hassle, consuming time that could have been spent on other important matters. But, thankfully, now that e-wallets have been introduced in the Philippines, we don’t always have to pay using cash any more.

So what is an e-wallet, anyway? It’s an app that allows users to make digital payments from their smartphones. Through this, users can conveniently buy from online shops anywhere in the world or even pay bills in the comforts of their homes. BDO Pay, GCash, Maya, and Coins.ph fall under this category.

GCash & Maya

GCash and Maya are the two leading cashless payment platforms in Manila, offering users a high level of convenience. Users can create an account for free, even without a bank account, and easily access essential services such as cashless payments and utility bill payments through their dedicated apps.

However, some services may be restricted until users complete identity verification by submitting a government-issued ID, which can be done directly within the app. Depositing funds is simple, with options available at convenience stores, supermarkets, and other locations nationwide. Additionally, users can link their bank accounts or PayPal accounts for seamless fund transfers.

Users can also open a regular savings account, with GCash offering an annual interest rate of up to 6.5% and Maya providing an impressive 15%, delivering exceptionally high returns. GCash further offers “GCash Jr.” for minors aged 7 to 17, allowing parents to link the account for managing allowances and other financial activities.

In the past, GCash and Maya each used their own QR codes, but with the nationwide adoption of the “QR PH” standard, most payment services now use a unified QR code, significantly enhancing convenience and usability.

BDO Pay

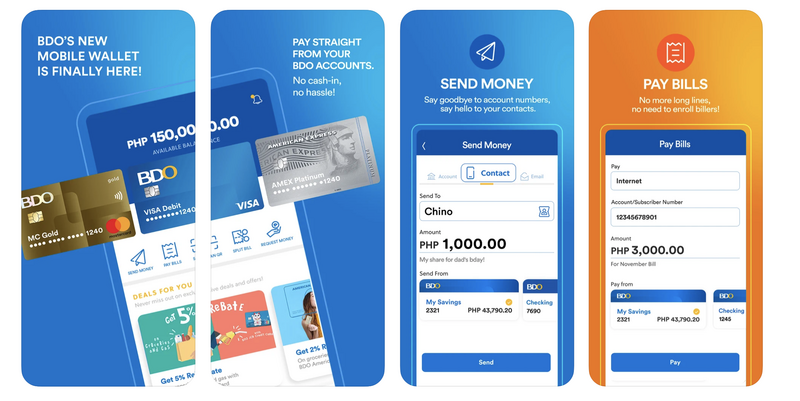

IMAGE from BDO

IMAGE from BDO

The BDO Pay is a user-friendly app that allows seamless money transfers to family and friends by simply entering their phone number. It also supports utility bill payments. Even without a BDO savings account, users can access the app by opening a BDO Pay account (which comes with an ATM card). For those who already have a BDO account, they can link it to the app as well.

The app includes a handy bill-splitting feature for dining at restaurants. It automatically calculates the total amount and allows users to send money to friends online. Additionally, users can make cashless payments by simply scanning a QR code at stores. BDO Pay can be downloaded for free through Google Play and App Store.