Expat’s Guide to the Special Retirees Resident Visa (SRRV)

The Philippine is increasingly becoming a go-to destination for retiring foreign nationals, especially those coming from the West. Some of their reasons for retiring include warmer temperatures, friendly locals, and a lower cost of living compared to other Asian countries.

Most people who want to retire in the Philippines usually look for a local to marry. However, there is a more flexible and safer, albeit a bit more expensive: a Special Retirees Resident Visa, or SRRV.

What is the Special Retirees Resident Visa?

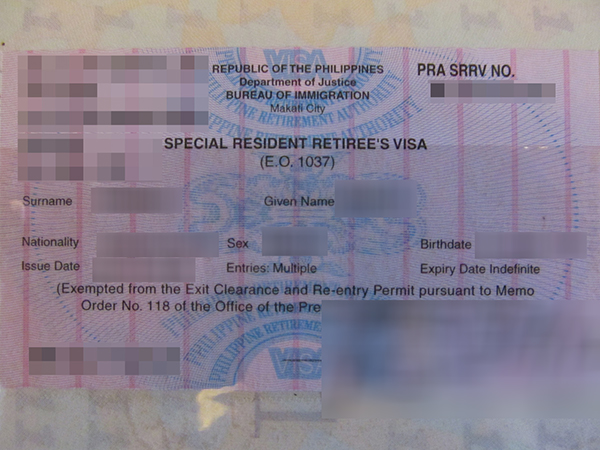

SAMPLE SRRV

The SRRV is a special non-immigrant visa offered exclusively by the Philippine Retirement Authority (PRA). It entitles foreign nationals and natural-born former Filipino citizens to reside in the Philippines indefinitely with multiple-entry privileges.

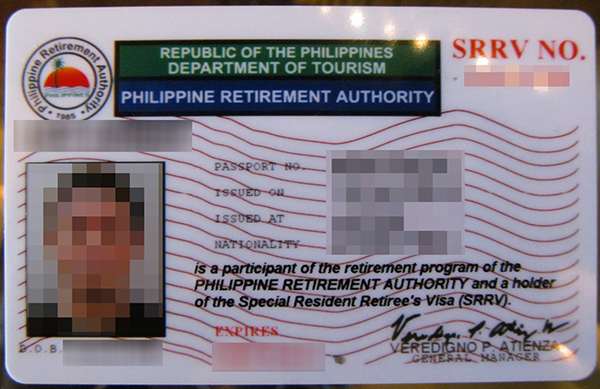

PRA ID. A more compact proof of being an SRRV holder.

There are four options for you to choose from when you apply for an SRRV:

- The SRRV Smile and Classic options are for active/healthy retirees. The Smile is usually taken by retirees 35 years old and up who can maintain a US$20,000 deposit while the Classic is for those who usually have a pension.

- The SRRV Courtesy/Expanded Courtesy is given to former Filipinos and Diplomats. Former Filipinos can get this starting at age 35, while diplomats can avail of this option at age 50.

- SRRV Human Touch is for an ailing retiree that’s 35 years old and up.

Benefits of getting an SRRV

Being an SRRV holder entails certain responsibilities, like an annual renewal process and maintaining your visa deposit for certain SRRV options, but these are outweighed by the privileges:

- Option to retire permanently. You can live, work, and study in the Philippines.

- Multiple entry privileges. No need to talk to immigration and run through the gauntlet of securing a multiple entry visa.

- Exemptions from the following:

- Income tax over your pension and annuities

- Exit and re-entry permits of the Bureau of Immigration (BI)

- Annual report at the BI

- Customs duties and taxes when you import household goods and anything else you own, up to a value of US$7,000

- Travel tax (if your stay is less than a year from your last entry date)

- Securing an I-Card

- Getting assistance from the PRA in obtaining basic documents from other government agencies, including but not limited to:

- Alien Employment Permit

- Driver’s License

- Tax Exemption/Extension Certificate

- Tax Identification Number

- National Bureau of Investigation (NBI) Clearance

Requirements

Here’s a list of what you’ll need to get an SRRV:

- A valid passport with a valid/updated tourist visa in the Philippines (visas sponsored by a travel agency/tour operator not accepted)

- An accomplished PRA Application form (which you can get here)

- Medical clearance

- Police clearance from your country of origin

- NBI Clearance (if you’ve stayed in the country for more than 30 days prior to your SRRV application)

- 12 pieces 2 x 2” photos

- Proof of relationship for dependents joining you

- Other documents deemed necessary by the PRA for the SRRV option you choose

You’ll also need to pay the following fees:

- Visa deposit depending on the type of SRRV

- Application fees: US$1,400 for the principal applicant, US$300 for each dependent, US$360 for the Annual Fee (PAF), which covers 3 family members

- For more than 3 retiree members in a family, an additional PAF US$100 for each additional dependent

- The PAF does not apply to SRRV Courtesy/Expanded Courtesy holders, except when they have more than 2 dependents. A US$10 for each dependent must be paid if you have more than 2 dependents for them to be issued a PRA ID Card.

SRRV and PRA ID photos grabbed from kondonator.seesaa.net

Source: Philippine Retirement Agency