A Traveller’s Guide to Using the ATM in the Philippines

Visiting the Philippines anytime soon? One of the things that might be lingering in your mind is whether to use Automated Teller Machines (ATM) or bring a large amount of cash. For individuals who prefer not to carry substantial amounts of cash, it is advisable to consider using debit or credit cards that facilitate withdrawals from local ATMs.

In this handy guide, Philippine Primer dives into the perks of using debit and credit cards, where you can access ATMs in the country, and how to use them effectively to make the most out of your travels!

IMAGE from Philippine Primer

IMAGE from Philippine Primer

Things to Consider

The usual worry of foreigners about money and ATMs when going to another country revolves around concerns related to accessibility, fees, and security. While you can explore cashless payments, still, navigating the nuances of a foreign banking system can be a concern.

In reality, it is not adviseable to bring a large amount of cash on a daily basis. A more secure and convenient option is to bring your credit or debit cards with you.

There are numerous ATMs all over the country, offering convenient access to cash. These ATMs typically operate round-the-clock (24/7). Most establishments in major cities and tourist destinations in the Philippines accept major international credit cards.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

If you’re planning to stay in the Philippines for a long period of time, you might also consider applying for a savings account in your preferred local bank. This can provide you with a more stable and secure way to manage your finances during your stay.

Local banks in the Philippines usually offer a range of services for foreign account holders, including online banking, which can make it easier for you to monitor and manage your funds.

Check Your Card

Prior to making withdrawals, take a moment to examine the back of your card and identify the network it is affiliated with. You can also check the ATM for its network affiliations through the logos placed around the machine to know if you can use this specific ATM for cash withdrawals. For BDO, one of the major banks in the Philippines, you may find these logos on the left side of the machine.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

Cirrus and Plus networks are widely recognized for cash withdrawals. Cirrus represents the global Mastercard or Cirrus ATM Network, which ranks among the largest ATM networks globally. On the other hand, Plus, operated by VISA USA Inc., is an international interbank network that facilitates ATM transactions.

For cash advances in the Philippines, MasterCard and VISA are widely accepted, and transactions are typically conducted in the local currency of the country.

It is important to be aware that ATMs may have daily withdrawal limits, and certain terminals may impose charges for cards not issued in the Philippines. Keep these considerations in mind for a hassle-free banking experience!

Using the ATM in the Philippines

Making the most out of your stay in the Philippines does not have to be complicated. Enhance your travel experience by unlocking the convenience of using ATMs in the Philippines using this easy-to-follow guide.

1. Insert Card

Once you have checked that your ATM card is affiliated with the bank, you may now insert your card through the slot, located on the right side of the screen. Make sure that it is inserted correctly, usually face-up. Always ensure that the magnetic stripe or chip on your card is facing the correct way based on the indicated instructions on the machine.

Some ATMs will also provide a prompt to let you choose your language, but English is the most widely available option.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

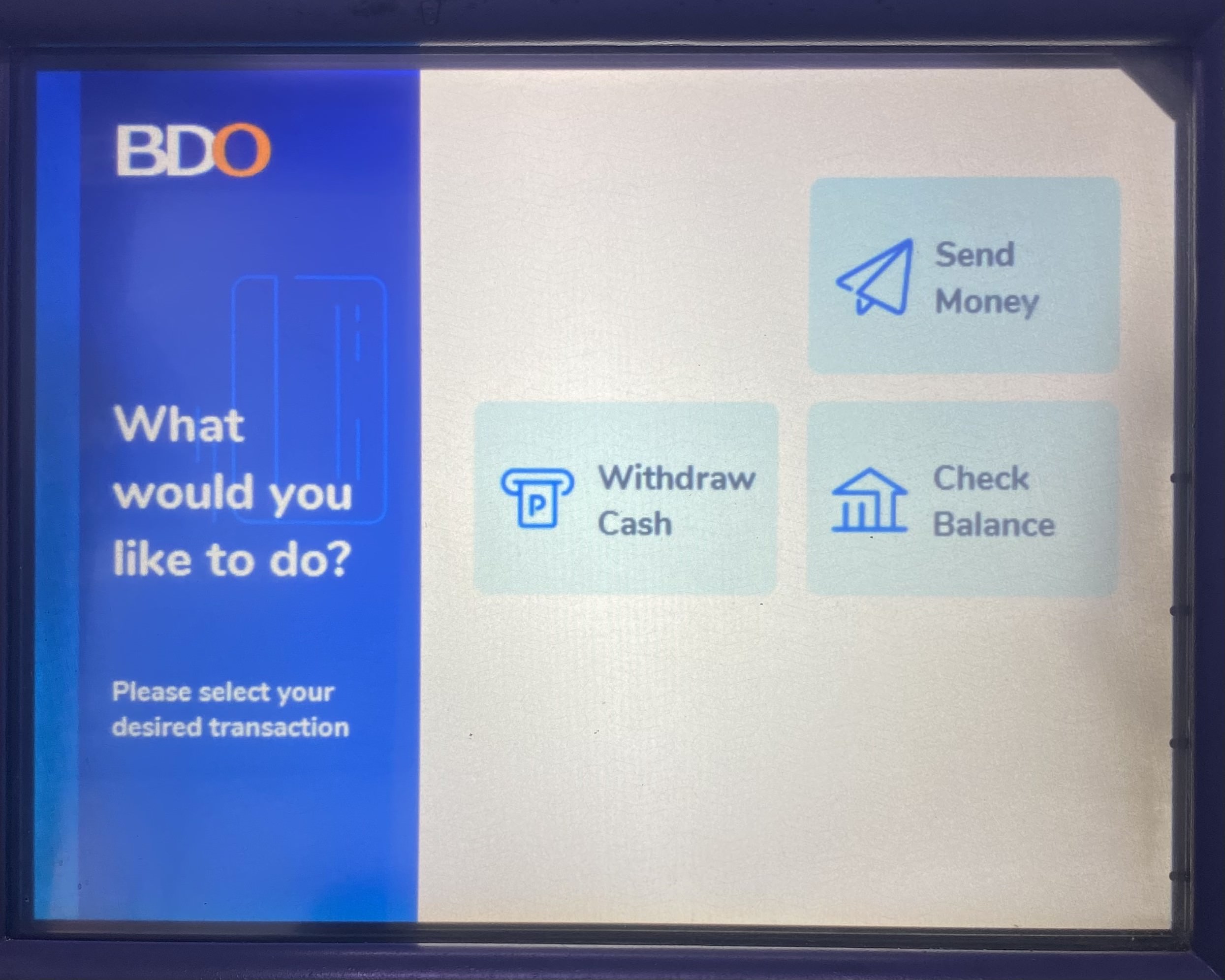

2. Select Your Desired Transaction

Aside from withdrawing funds from your account, you may also check your balance and send money through the ATM.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

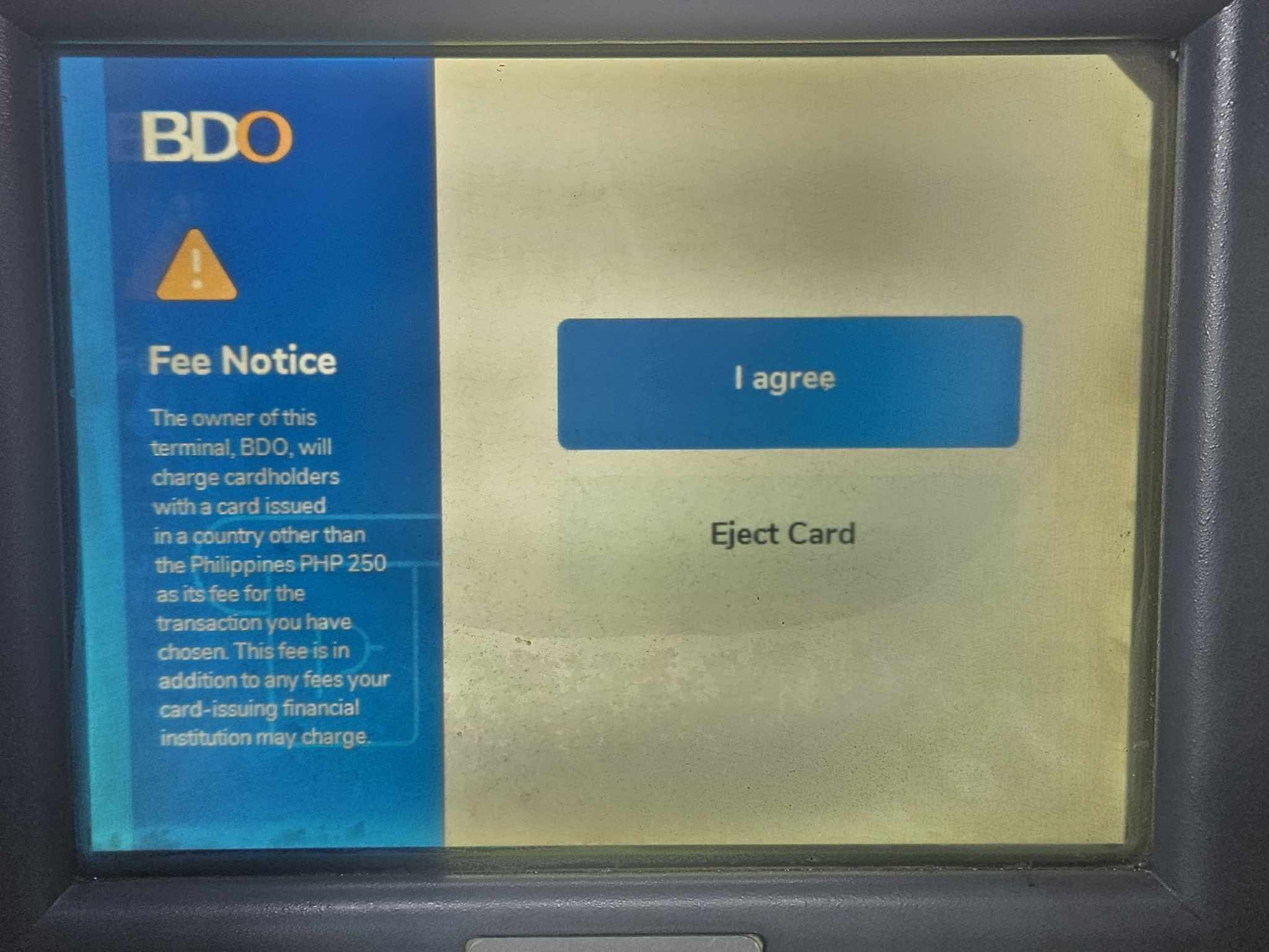

After choosing the “Withdraw” option, a prompt will appear, informing you of of additional fees that will be incurred with the transaction. For BDO, cards issued overseas are charged Php 250 which are subject to additional fees from your home bank.

Make sure to tap “I agree” to proceed with your transaction.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

3. Select Your Account Type

You will be asked to select your account type. A ‘Savings’ account, which earns an interest, is usually where you store your money for emergency. A ‘Current’ account, on the other hand, is also called a ‘checking’ account where day-to-day banking transactions are usually done.

There is a withdrawal limit for every local bank that you wish to withdraw from. For BDO, the maximum amount per day amounts to Php 50,000 with a Php 25,000 maximum amount per single transaction (per withdrawal). The minimum amount that you may withdraw is Php 200.

Please take note that the withdrawal limit may vary based on the type of card you have, whether it is affiliated with a BDO account or issued by a different bank.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

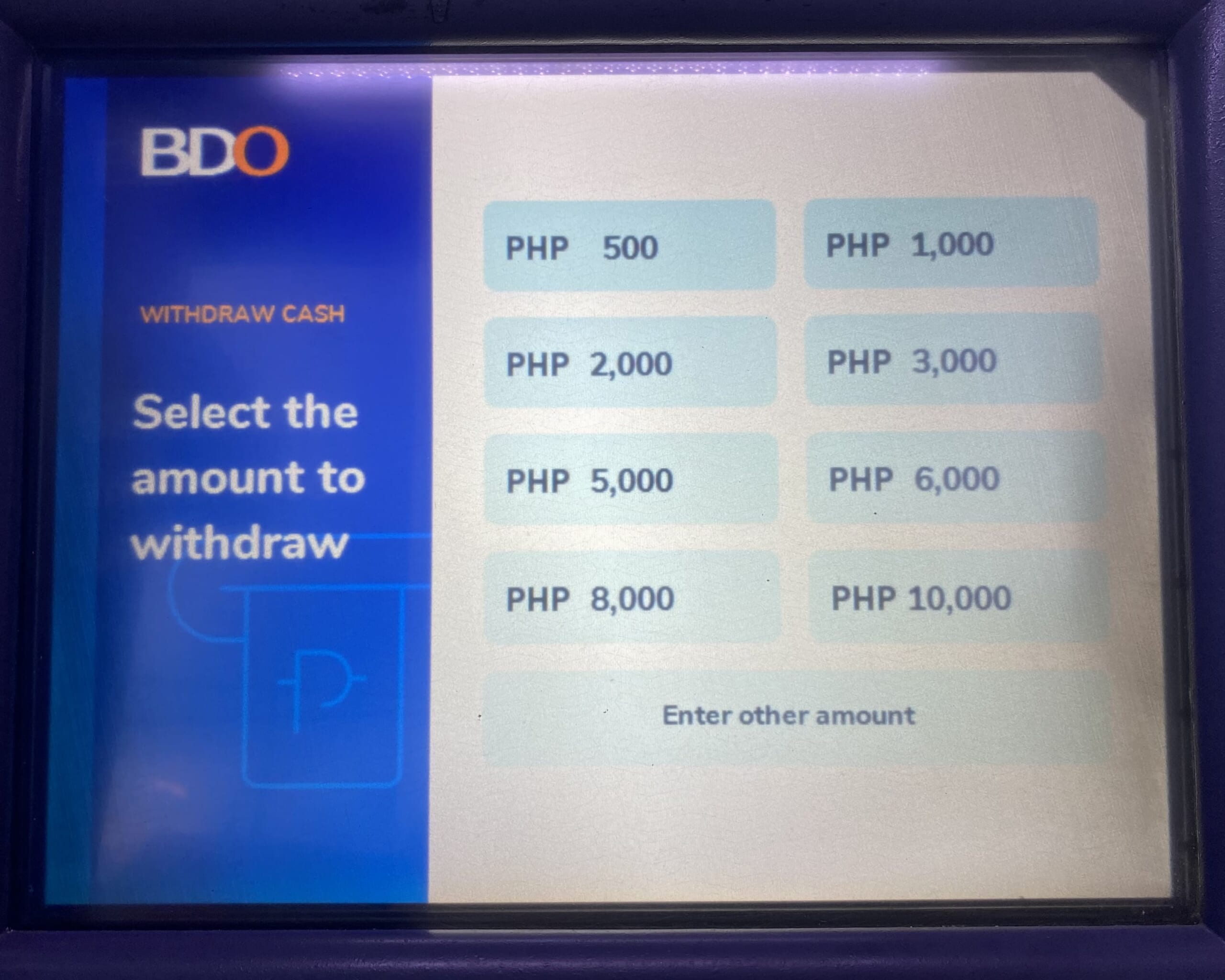

4. Select the Amount

The screen will usually prompt you to choose an amount to withdraw, in which case, you may choose from these options for faster transactions. Some banks, which may not show this prompt, will allow you to enter your desired amount. Either way, double check if the amount you have entered is correct.

Note: Some banks, especially those in the provinces, might not have enough cash in the ATM for your desired option. You may opt to choose a lower amount of money and withdraw again until you have your desired amount of cash. However, this might prompt you to make more than one ATM transaction.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

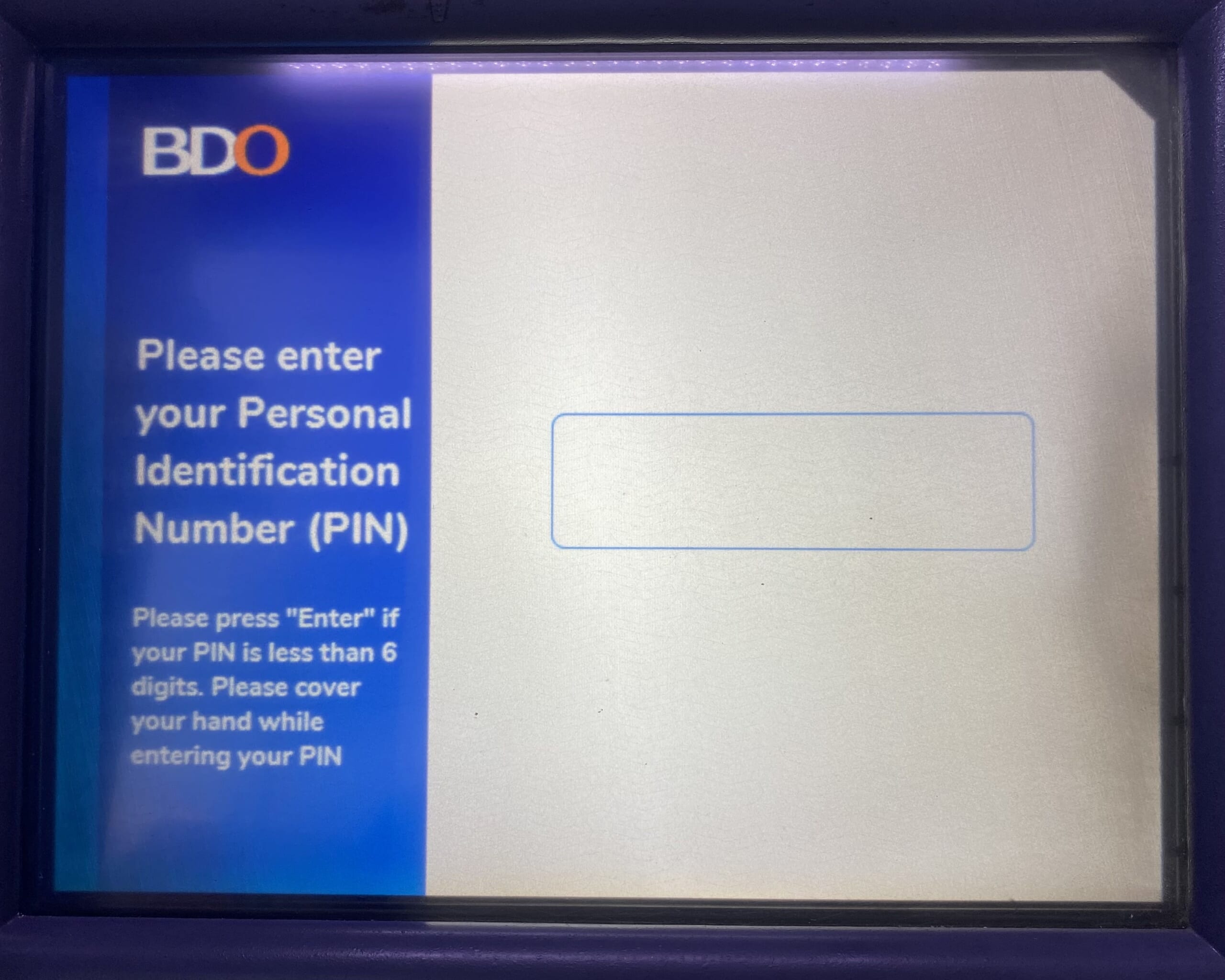

5. Enter Your PIN

Aside from the magnetic chip on your ATM card, your PIN is one of the most critical components of your transaction. Please make sure not to share it with anyone. For added security, cover your hand while entering your PIN using the ATM PIN pad. If your PIN is less than six (6) digits, press ‘Enter’ on the pad to complete the transaction securely.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

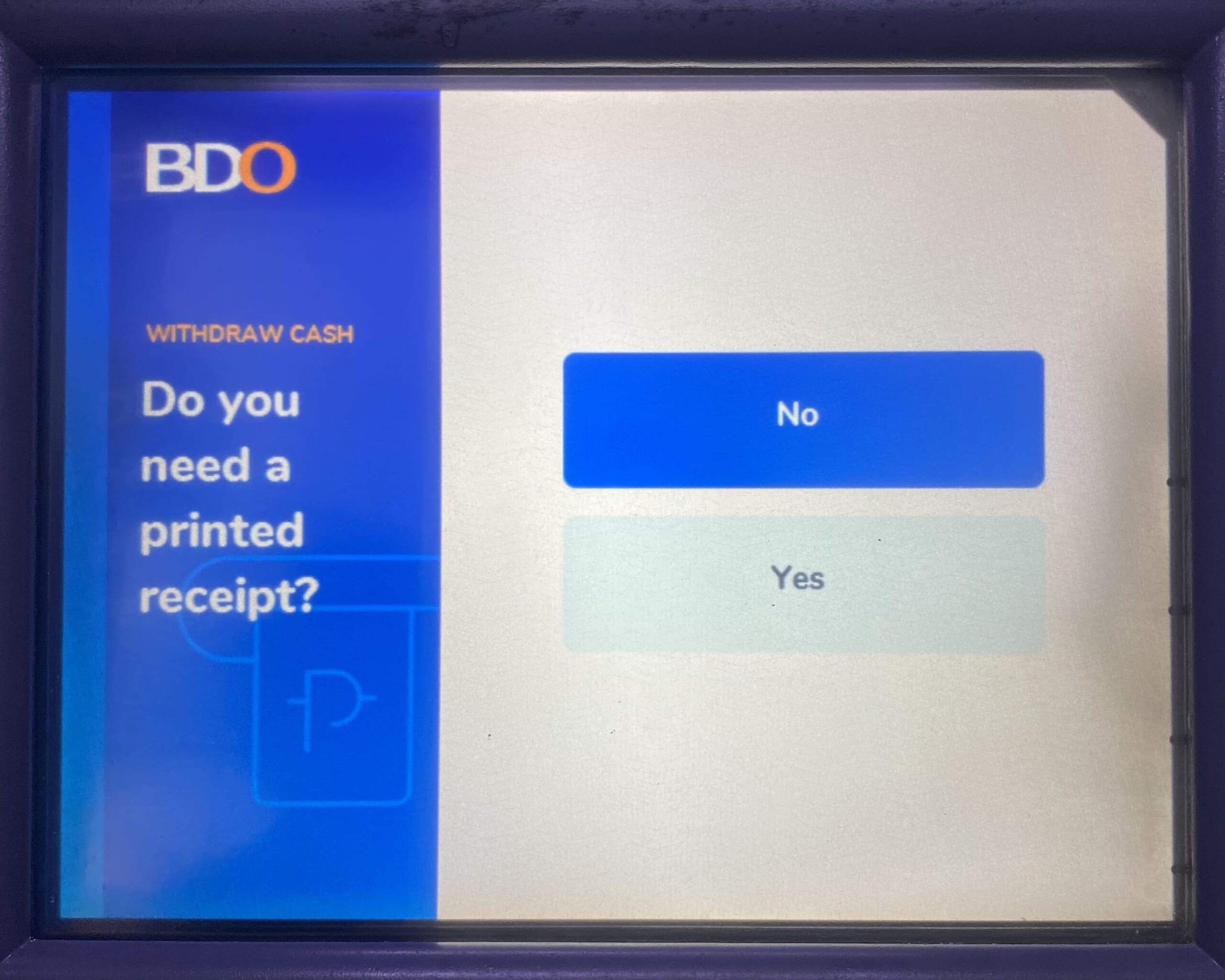

6. Request for a Printed Receipt. Or Not.

Thanks to the banks’ sustainability measures and a progressive shift toward online banking, the majority of ATMs in the Philippines now offer an option to skip receipt printing. However, if you prefer to have a physical record of your transactions and account balance, you can press ‘Yes’ to continue. In such cases, please ensure to wait for your receipt before leaving the ATM.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

7. Wait for the ATM to Return Your Card and Dispense Your Cash

Once the ATM has returned your card and dispensed your cash, secure them, and wait for your receipt before leaving. Please be reminded that your ATM card will be returned to you first, so do not forget to wait for your cash and then your receipt.

IMAGE from Philippine Primer

IMAGE from Philippine Primer

The sequence of steps for your ATM banking transactions will depend on the local bank’s system, so please read the instructions on the screen carefully before you proceed.

Additionally, if possible, make your transactions with ATMs that are attached to a bank to inform them immediately of some unfortunate incidents, such as when your card is stuck into the ATM and other concerns related to your account.

With these added functions and differing terms of local banks, it is important to check the local bank’s website and stay informed of their banking schedules and hotline numbers, so that you may contact them for any questions or concerns. You may visit International Banking | BDO Unibank, Inc. which includes international desks for Chinese, Europeans & North Americans, Japanese, and Koreans.

With the holidays fast-approaching and vacations on the horizon, we hope that this guide will help you in understanding local networks, managing fees, and navigating ATMS in the Philippines. Wishing you smooth transactions and joyful travels!