TRAIN Package One: A Need-To-Know Guide to Republic Act 10963

It’s not every day that something tax-related makes waves on social media. Taxes usually mean a burden, but with the implementation of the recently-signed Republic Act 10963, otherwise known as the Tax Reform for Acceleration and Inclusion (TRAIN) Law, your upcoming payslip suddenly became a welcome-ish sight.

THIS WILL BE A LOT SIMPLER. Computing for your taxes will be simpler thanks to the implementation of TRAIN’s Package One.

THIS WILL BE A LOT SIMPLER. Computing for your taxes will be simpler thanks to the implementation of TRAIN’s Package One.

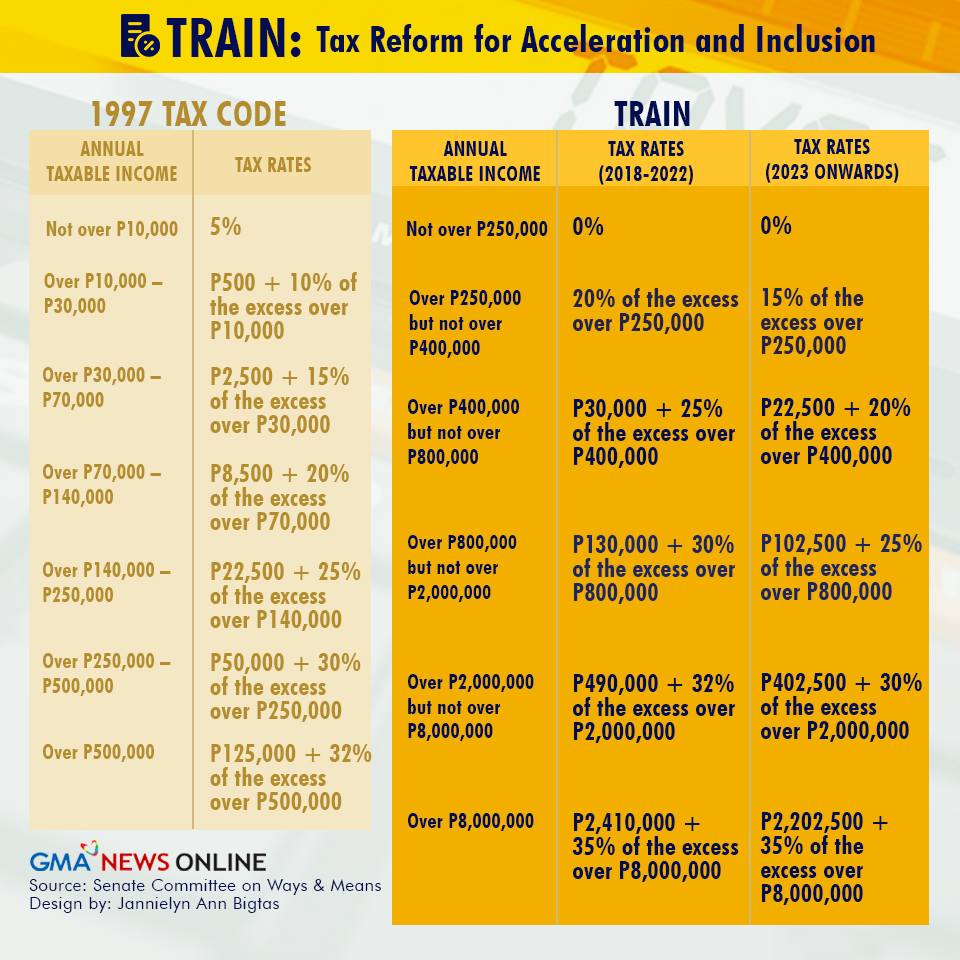

Questions have been thrown around regarding TRAIN, most of which has to do with what will happen once that first payslip comes in. To clear up the air, here’s a handy guide paired with graphics from GMA News Online to better understand TRAIN:

More money in our pockets

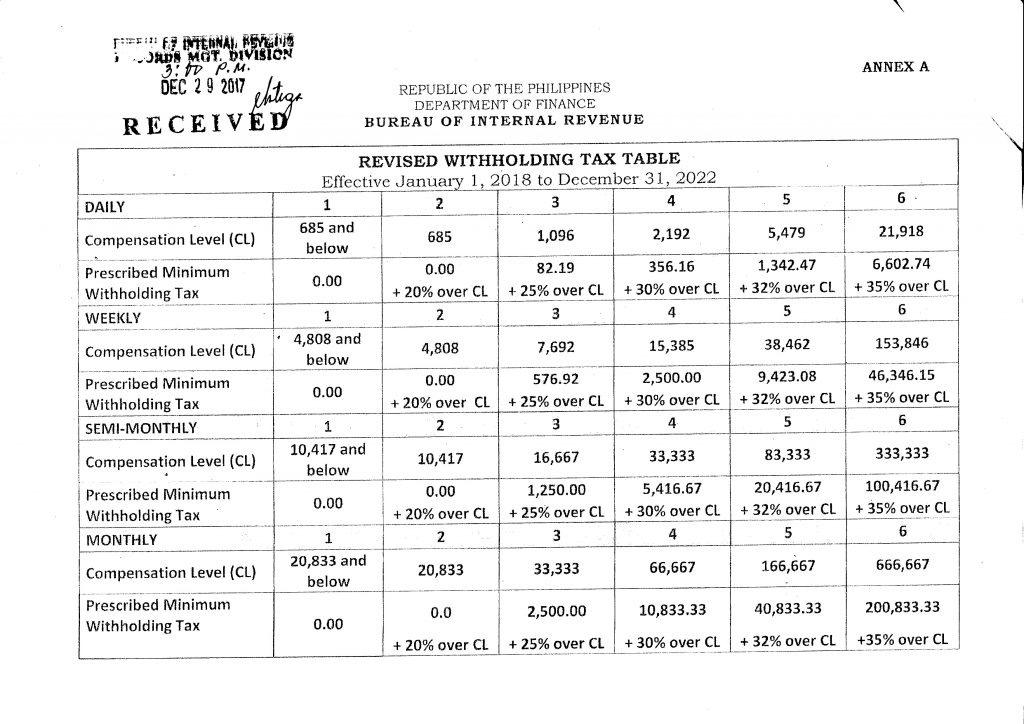

Here’s the deal: if your basic pay per month is at Php 20,833 and below (that’s Php 10,417 if you’re paid twice a month), you won’t be charged any withholding tax. Any higher and you’ll be deducted tax based on the table you see here.

IN CASE IT WASN’T CLEAR. Here’s how much you’ll be charged (or not charged) for taxes daily, weekly, semi-monthly, or monthly. Click on the image to enlarge./IMAGE Bureau of Internal Revenue

IN CASE IT WASN’T CLEAR. Here’s how much you’ll be charged (or not charged) for taxes daily, weekly, semi-monthly, or monthly. Click on the image to enlarge./IMAGE Bureau of Internal Revenue

“What if I’m married or a father/mother to a number of kids?” That’s all in the past. Those exemptions made withholding tax collections complicated, so they got rid of it. Besides, you’ll be paying even less tax than you will be from now on.

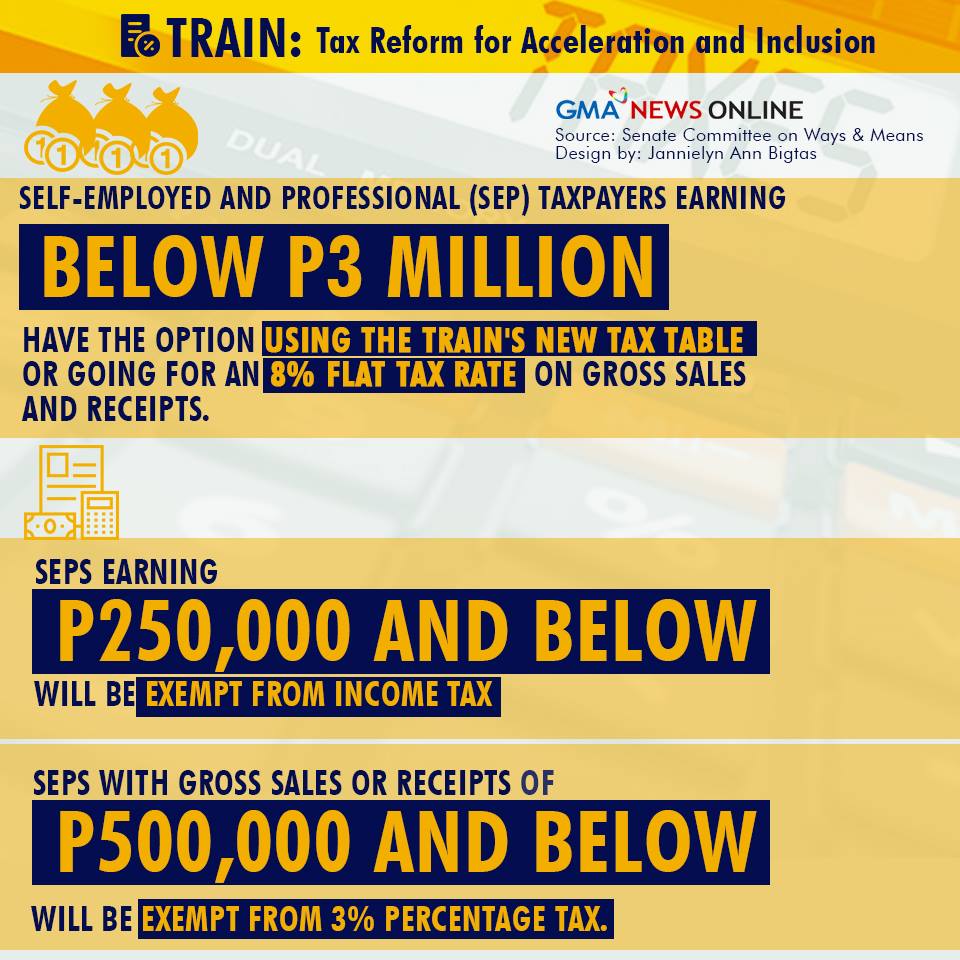

Self-employed and mixed-income earners will also benefit from TRAIN. Yes, the government didn’t leave you guys out. You have an option of using the new tax table or paying an 8% flat tax rate if you earn less than Php 3 million yearly in gross sales and receipts.

Are you an expat or Filipino currently working for a multinational corporation who’s RHQ or ROHQ is in the Philippines? Your taxes will be adjusted as well. You’ll be taxed 15% of your gross income, i.e. everything that goes into your paycheck.

Oh, and by the way, your 13th-month pay and other benefits are considered tax-free if they don’t crack the Php 90,000 ceiling.

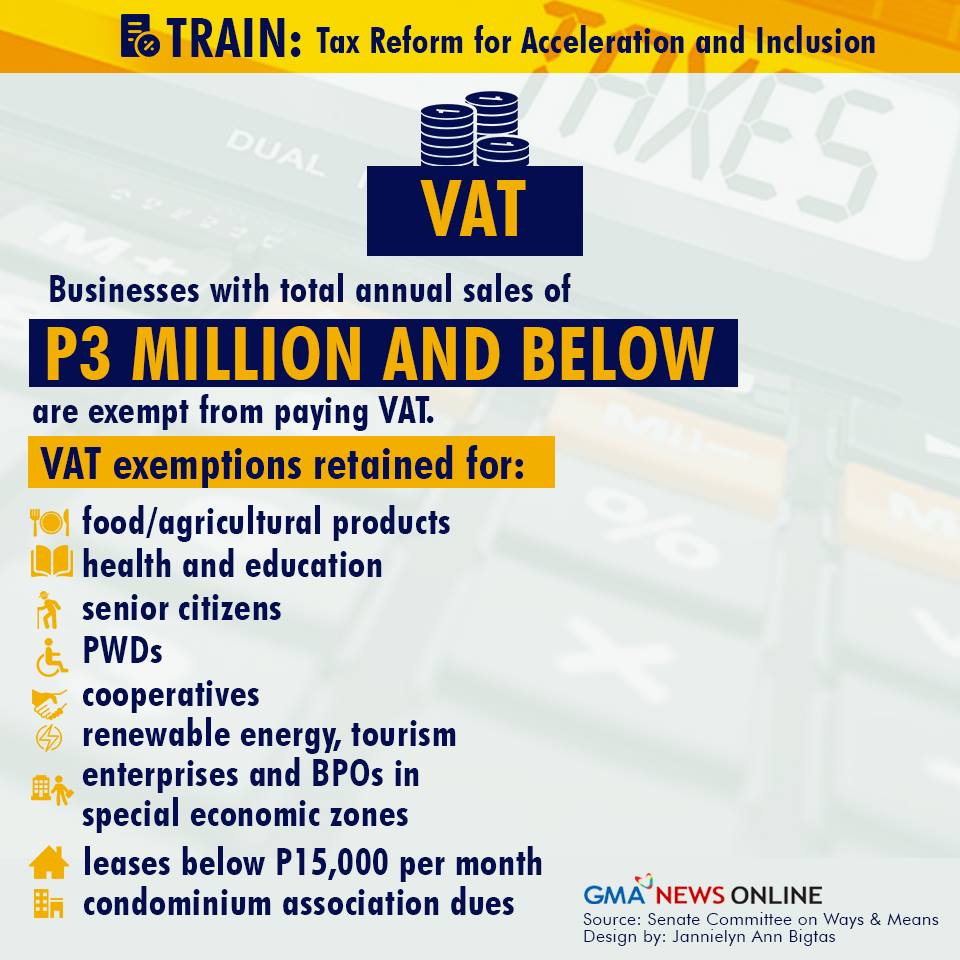

We know how much of a burden paying taxes is if you’re a business owner. You’ll be happy to know that TRAIN also lends a hand to businesses who don’t earn as much as the more established names.

If your business earns less than Php 3 million yearly, you don’t need to pay the 12% value-added tax.

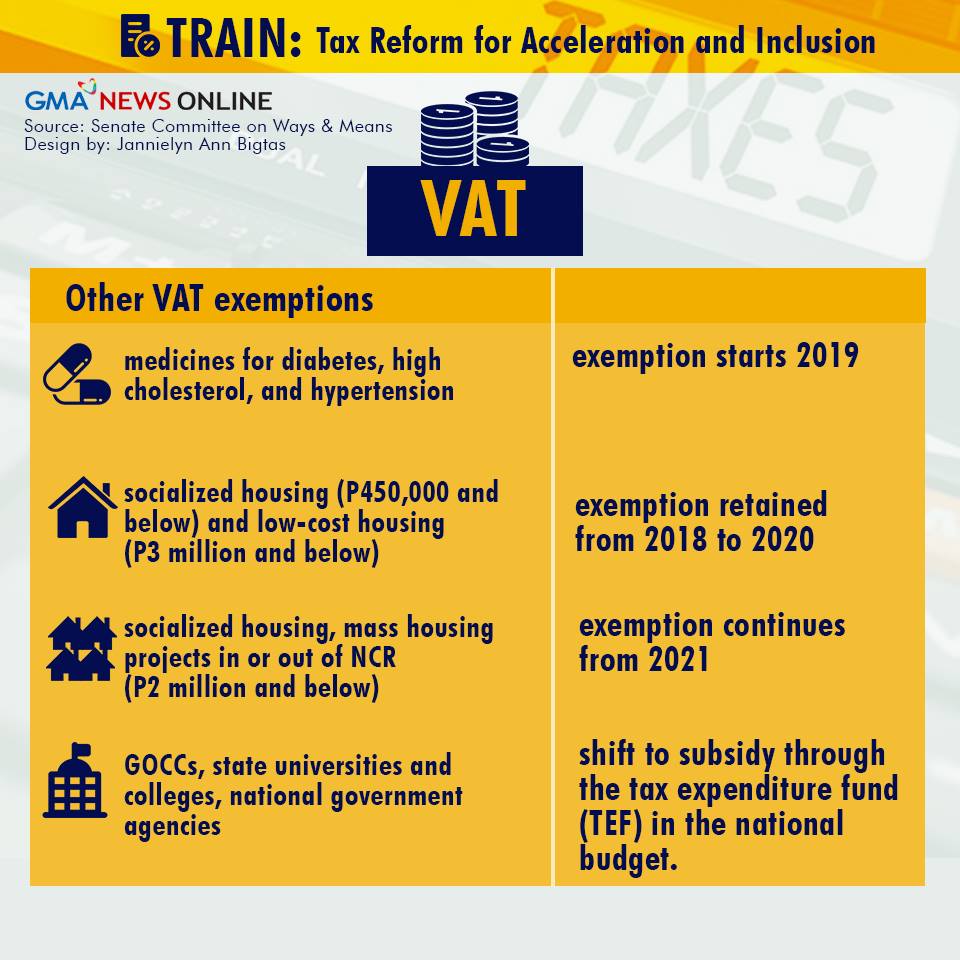

OTHER VAT-RELATED EXEMPTIONS. Yes, adjustments happened in these areas as well.

OTHER VAT-RELATED EXEMPTIONS. Yes, adjustments happened in these areas as well.

All well and good, yes? We get more money in our pockets! But wait, there’s more.

More taxes collected elsewhere

“With the government collecting less from our paycheck, where will they get the funding for their projects?” Well, here are the answers to that one burning question.

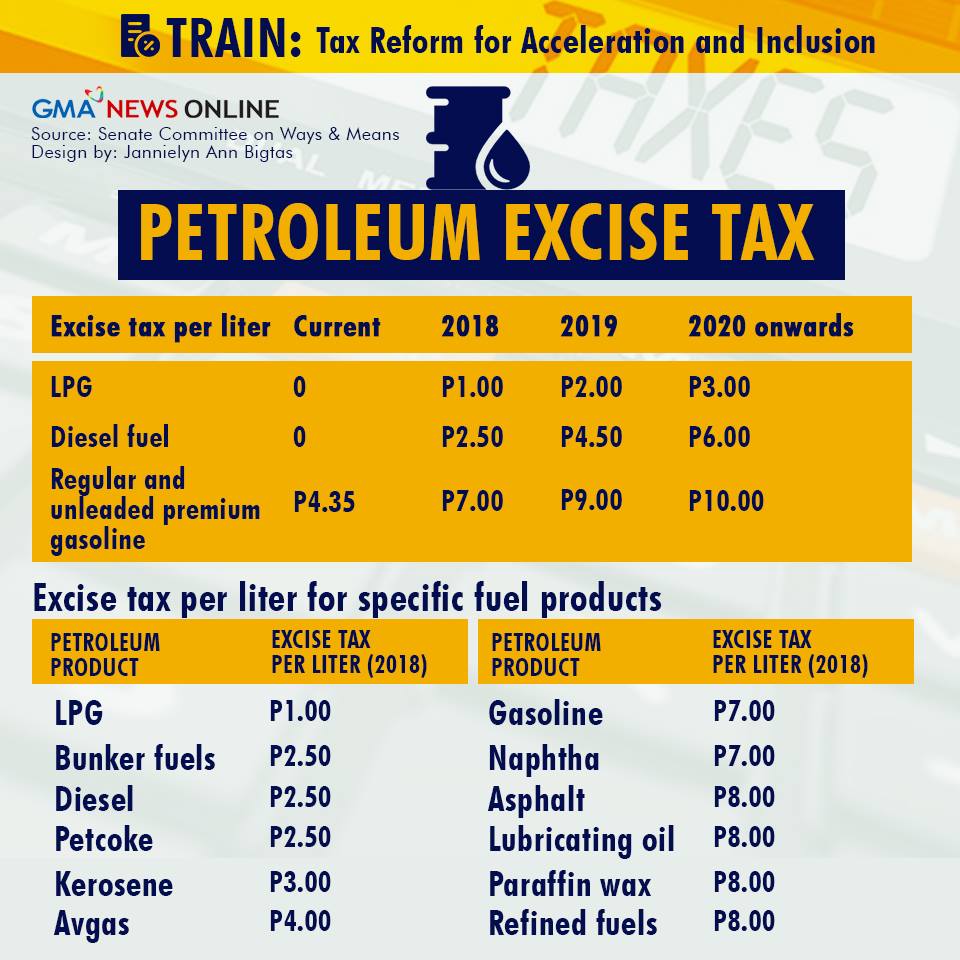

Yes, we all knew this was coming. Every time the price of petrol goes up, the rest of the market gets affected. Make sure you have extra space in your monthly budget for higher fares and gas prices, and probably for everything else you’ll buy in 2018.

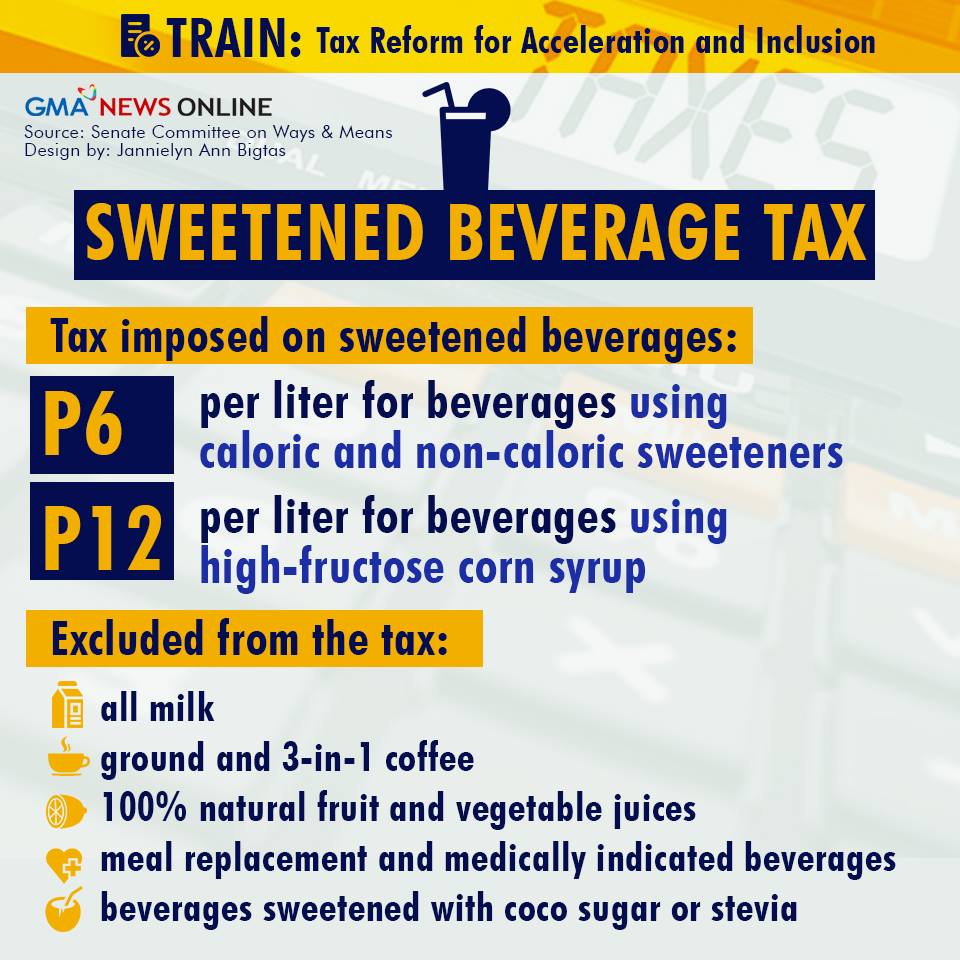

Unless you drink a lot of natural fruit and vegetable juices, milk, coffee (ground, 3-in-1, and powdered), or drink something to replace meals, you’ll be paying more for your cup, can, or bottle of sweetened beverage. A flat rate of Php 6 or Php 12 per liter will be charged depending on the sweetener used.

Of course, you can get around it by using coco sugar or stevia, but that’s up to the manufacturer.

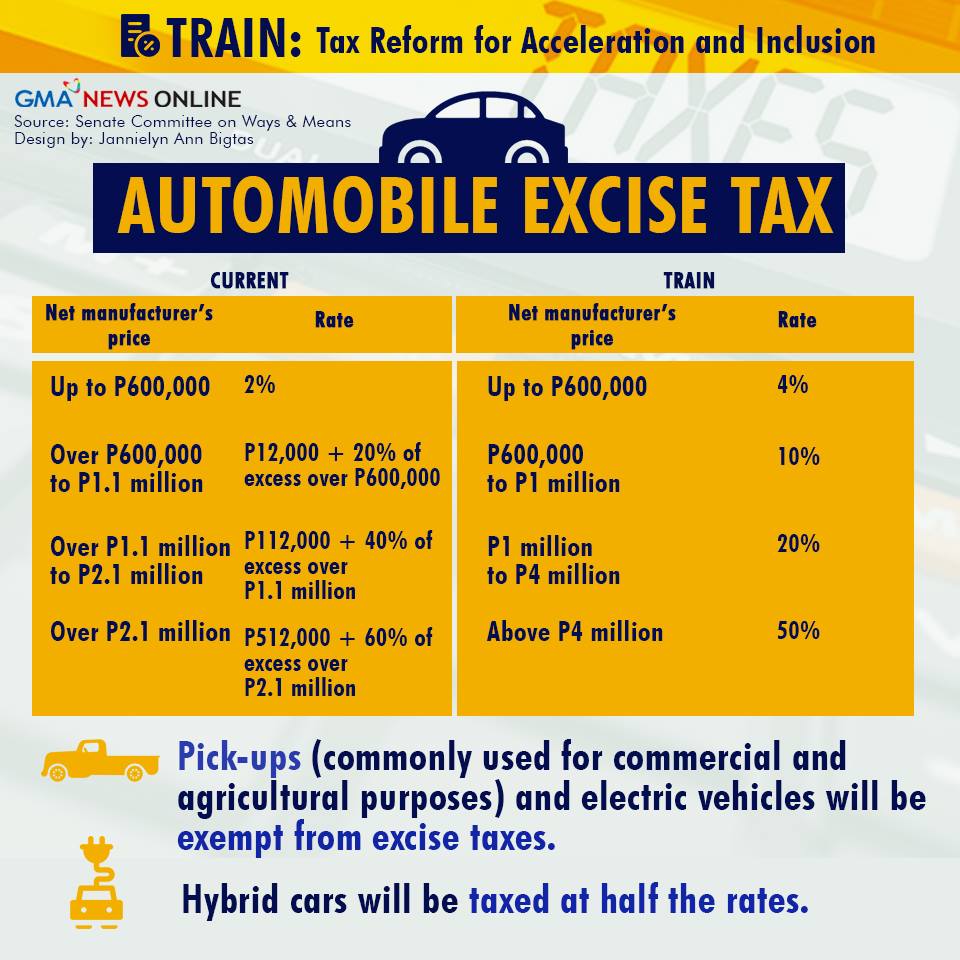

Another part of TRAIN that created a lot of buzz was the automobile excise tax. Prices for any four-wheeled (or more) vehicle that runs purely on gas or diesel and isn’t a pick-up or is not 100% electric will be charged a flat tax rate based on what you see here.

Iffy about going 100% electric? Go for a hybrid; it’ll be taxed at half the rates and you’ll be doing Mother Nature a favor.

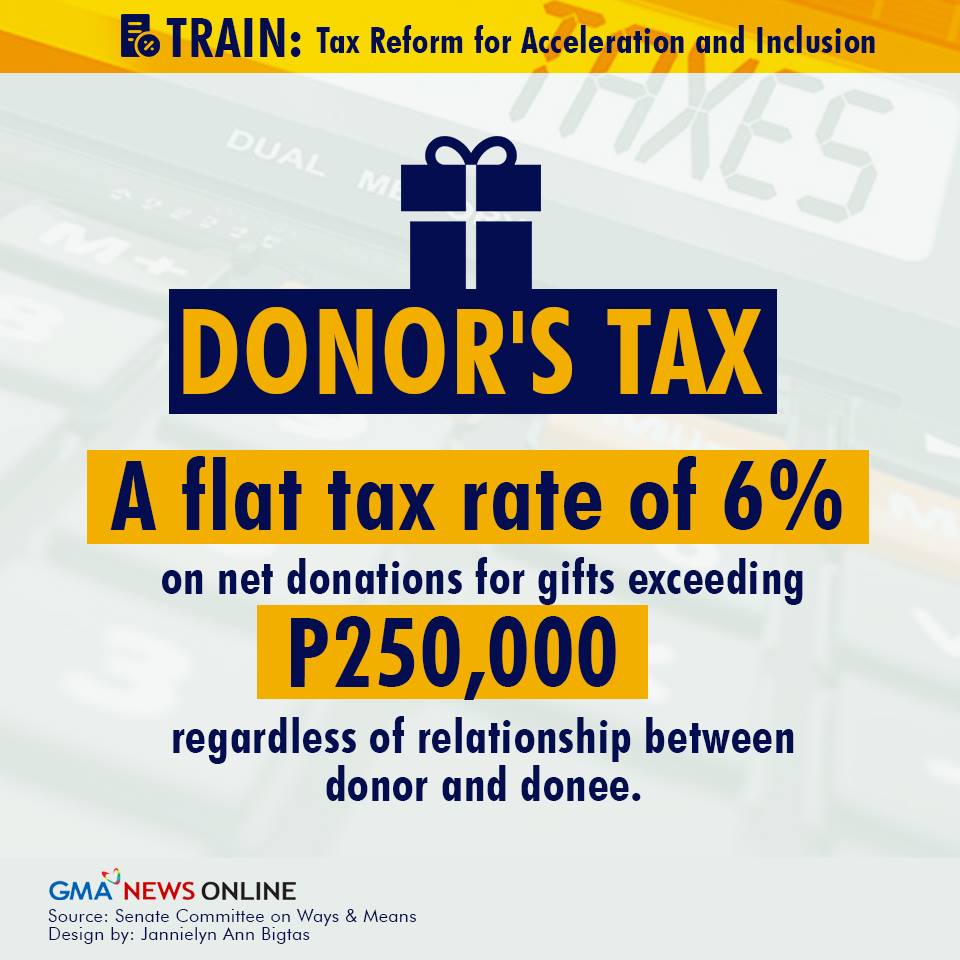

Donating to a cause? The same 6% tax rate applies to net donations that crack the Php 250,000 ceiling, regardless of your relationship to the one accepting your donation.

Want to know where else the government will get their funds through taxes? Here’s a quick rundown:

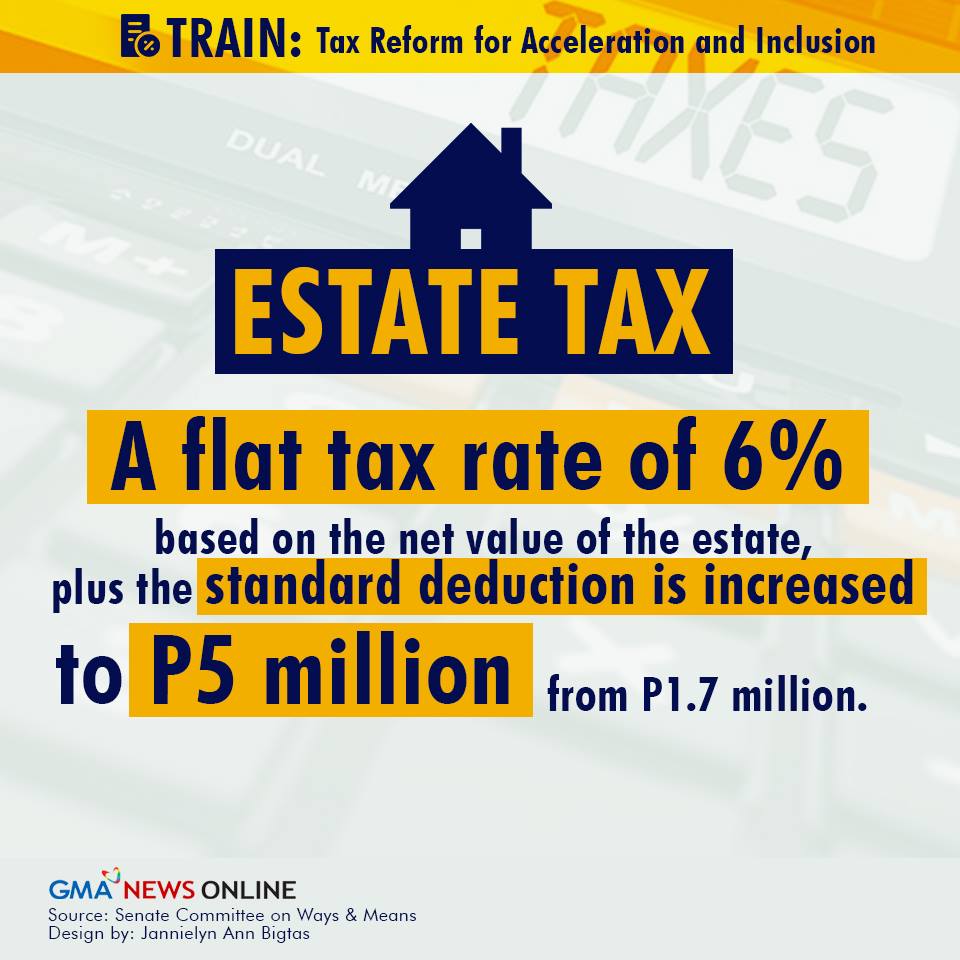

Estate tax

Estate tax

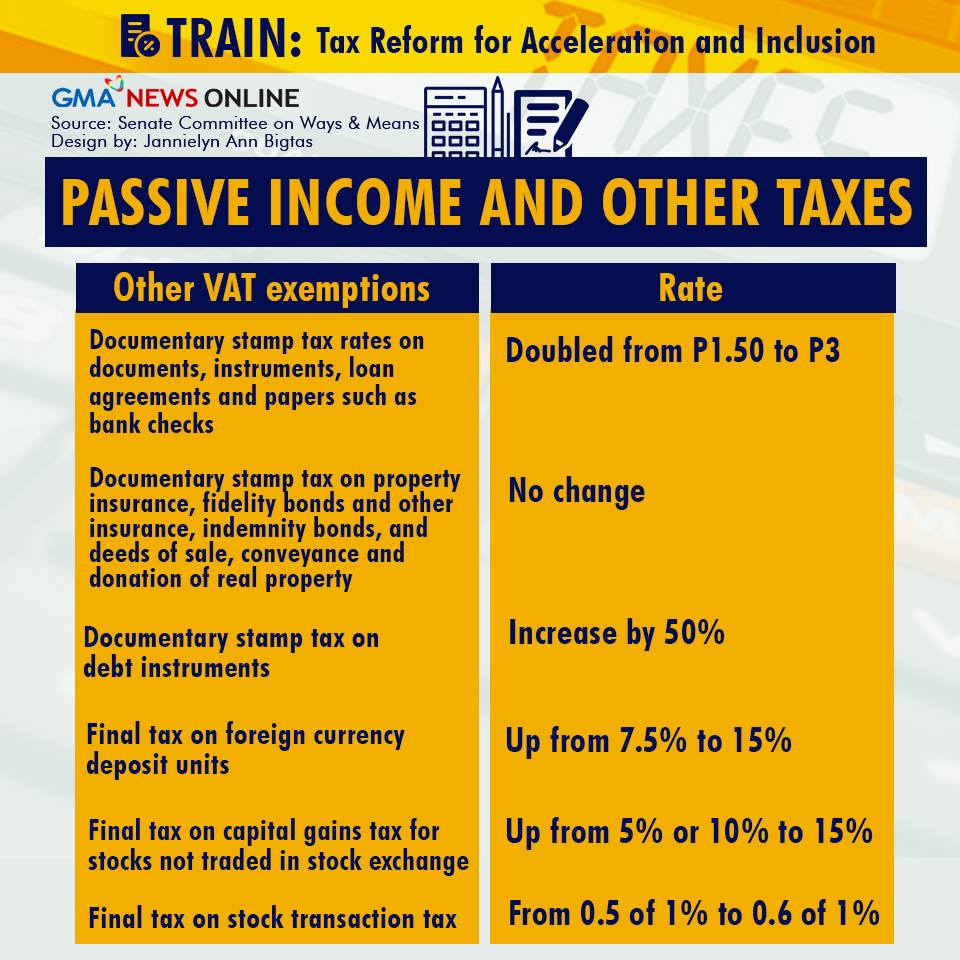

Documentary stamps, foreign currency deposits, stocks not traded in the stock exchange, stock transaction tax

Documentary stamps, foreign currency deposits, stocks not traded in the stock exchange, stock transaction tax

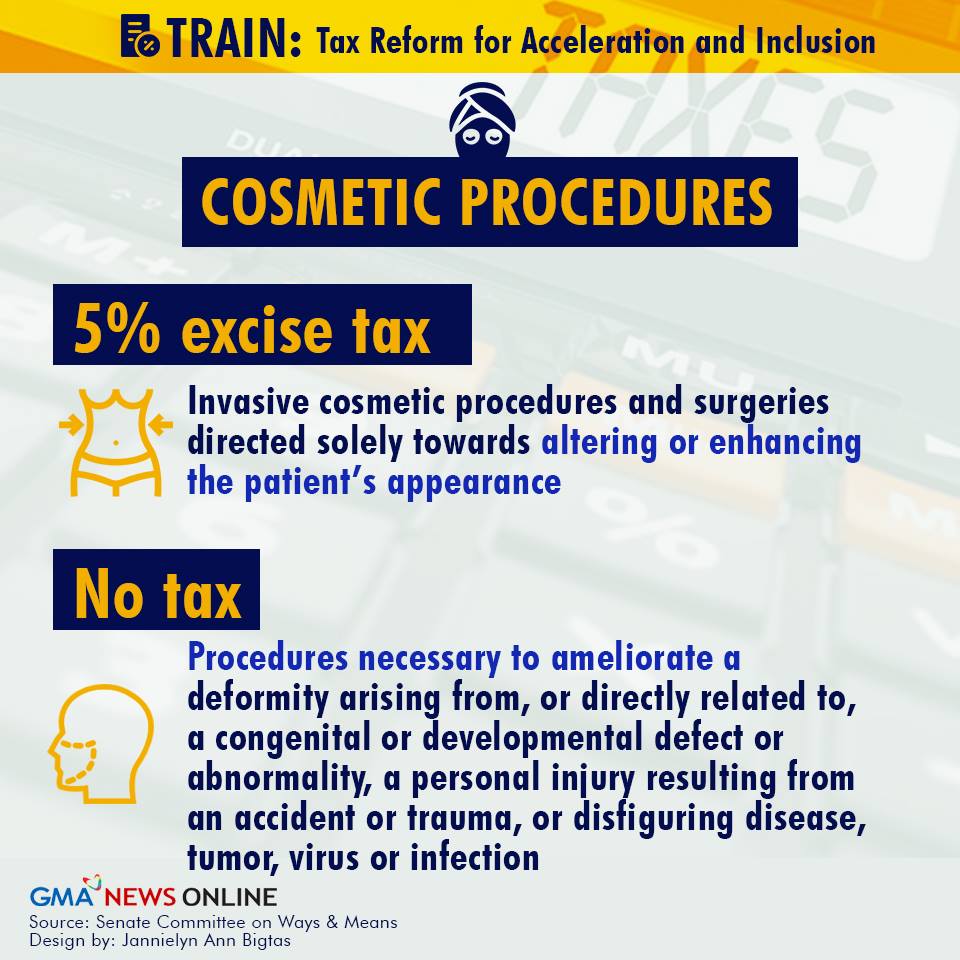

INVASIVE COSMETIC PROCEDURES AND SURGERIES. Yes, Dra. Vicky Belo’s work will be levied a 5% tax unless it is absolutely necessary.

INVASIVE COSMETIC PROCEDURES AND SURGERIES. Yes, Dra. Vicky Belo’s work will be levied a 5% tax unless it is absolutely necessary.

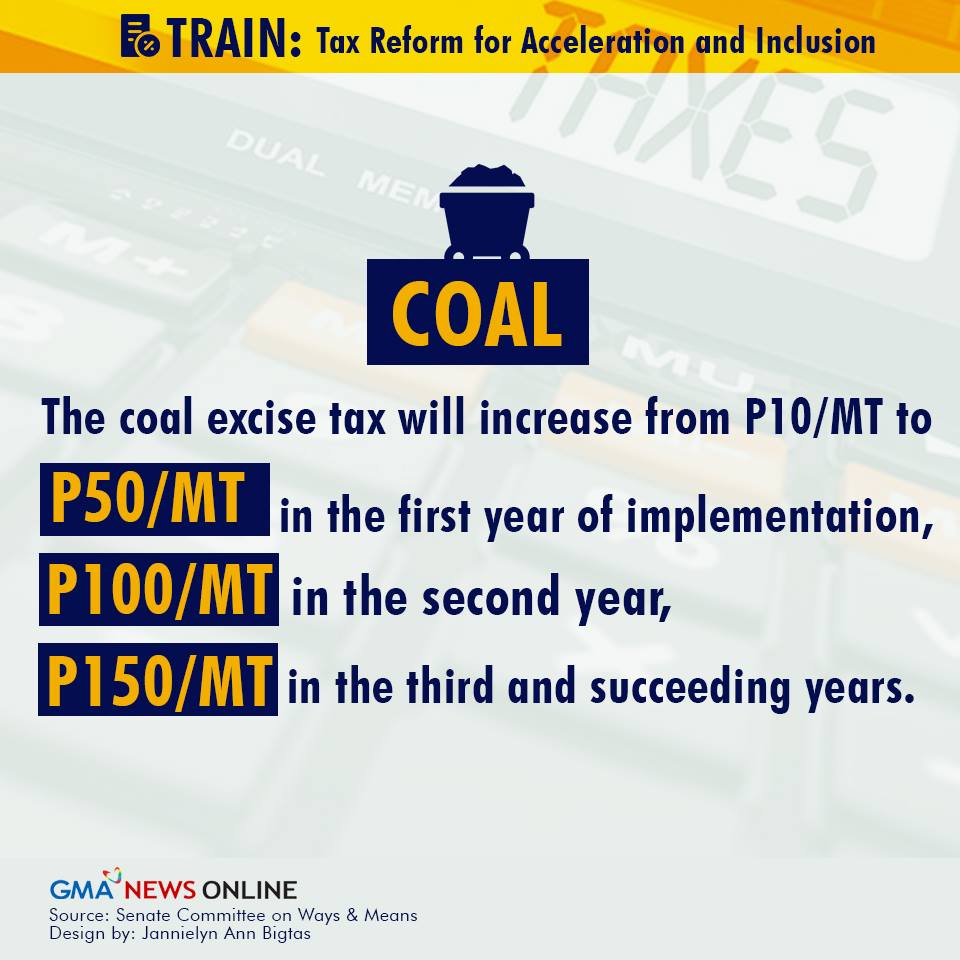

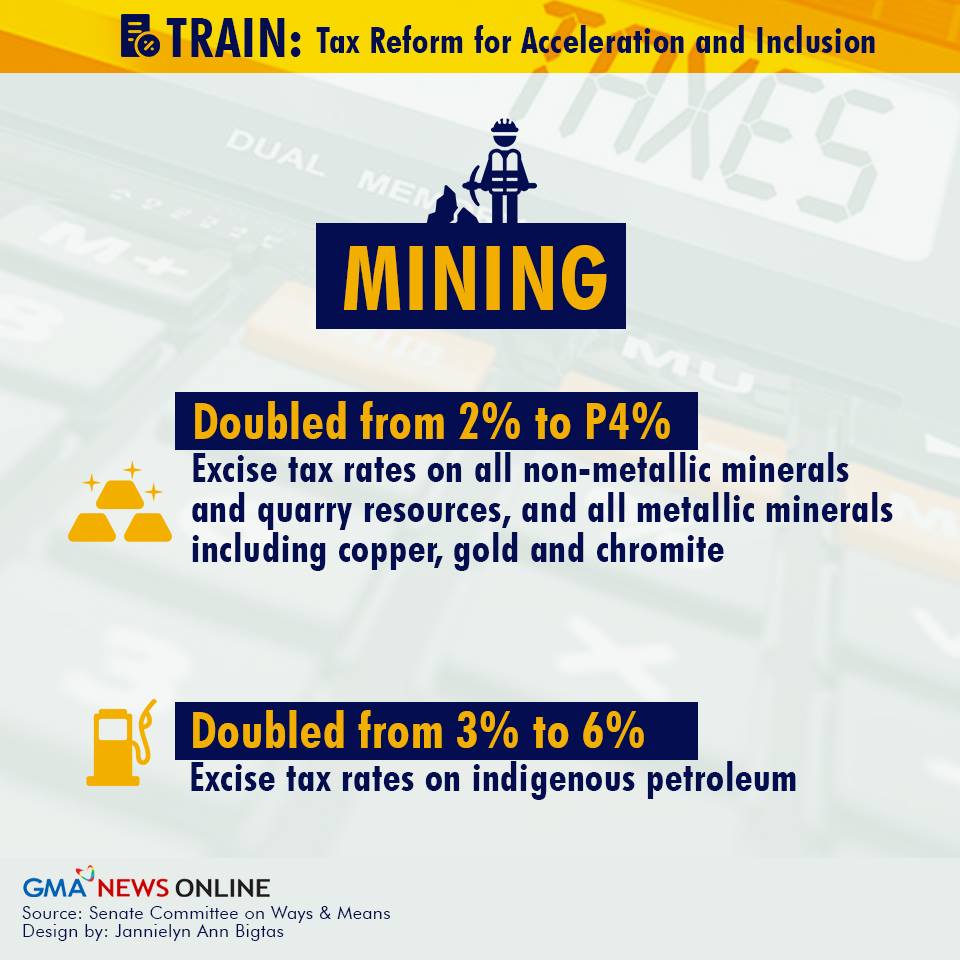

COAL MINING AND MINING IN GENERAL. From Php 10 per metric ton all the way to Php 150 per metric ton! Also, double the tax rates for anything else mined from within our territories!

COAL MINING AND MINING IN GENERAL. From Php 10 per metric ton all the way to Php 150 per metric ton! Also, double the tax rates for anything else mined from within our territories!

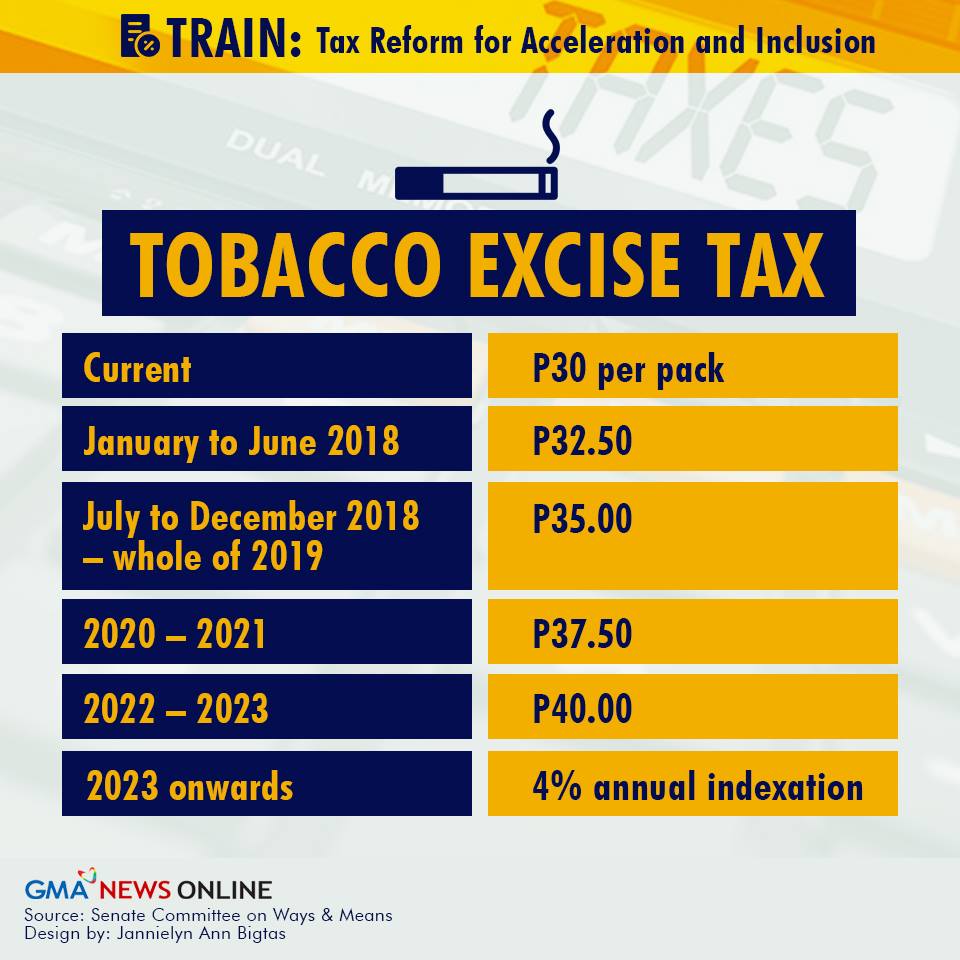

TOBACCO EXCISE TAX. Yes, smokers. You all knew this was coming. Time to ditch that deadly habit.

TOBACCO EXCISE TAX. Yes, smokers. You all knew this was coming. Time to ditch that deadly habit.

Now that we’re all up to speed, let’s all pause and take in all that will come out of the implementation of TRAIN.

By the way, did we mention that this is Package One out of a possible four?

Written by Andronico Del Rosario

All infographics courtesy of GMA News Online

References: GMA News Online, National Revenue Code of 1997, RA 10963