Expats’ Guide to Tax Refund in the Philippines

The end of 2016 is coming in two days. For most of us, it marks the end of a year filled with firsts. Employees typically laud this time of the year as it gives us more than the year-end parties and events: it’s the time when we usually start computing for our annual tax refund (or lack thereof).

This is, however, a very complicated topic, especially for those lying outside the realm of your company’s accounting team. Here’s an explainer on what tax refunds are, why they exist, and (most important) if and how you can collect it if you’re a salaried employee.

What is a tax refund?

A tax refund (specifically, an annual tax refund) is defined as the “excess of tax withheld over the tax due on their annual gross income.” Simply put, it’s whatever excess tax your employer collected from you for the current year, if there is any.

It comes as a result of any of these two things happening:

- You’re a new hire who’s spent less than a year with your current company, hence leaving you with a little bit too much tax collected by your employer.

- You’ve changed your tax status (i.e. added a dependent, whether child or eligible family member) within the calendar year and have filed for a change of tax status with your employer.

Why does it exist?

Taxes are what the government uses to pay for everything they spend on: infrastructure projects, housing, scholarships, etc. The two most obvious sources are the Value-Added Tax (VAT) they impose on products we purchase from stores and a portion of the income we make from our jobs.

If you’re a salaried employee, you don’t need to worry too much about how you may (or may not get it). It’s enough to know that there are instances where your company takes away too much from your monthly pay because of the reasons stated above. There’s also the element of human error (employees in accounting are people too), but that rarely happens.

No one wants to be taxed too much (remember all those movies about the Middle Ages?), so your employer submits a list of documents, called alphalists, to the Bureau of Internal Revenue (BIR).

How can we receive a tax refund?

This one is easy enough to explain. If they deduct too much from your salary (which usually happens if you’ve switched jobs or tax status), your employer has to give that money back to you on or before January 25. Too little, and you’ll have to pay for those taxes by the end of January.

This means one thing: you MAY or MAY NOT receive a tax refund come payday on or before January 25.

In case you really want to know if you’ll be receiving a tax refund or not, here’s how it’s (roughly) computed:

Get your Net Taxable Compensation. Use the following formula for you to get your Total Taxable Compensation:

Total Taxable Compensation = (Annual basic pay + Overtime pay + 13th month pay + other taxable benefits) – (SSS + PhilHealth + PagIbig Contributions + Nontaxable allowance)

Once you have your Total Taxable Compensation, take away any exemptions you may have:

- Single w/o qualified dependents – P50,000

- Head of Family – P50,000

- Married individual – P50,000 (can only be claimed by you or your spouse, not both)

- Additional exemption – P25,000 for each qualified dependent, but only up to 4

- This may only be claimed by the husband who is deemed Head of Family, unless you give that to your wife

- Single individuals considered as Head of Family supporting a qualified dependent

- Spouse with custody of child or children. Both can claim the additional exemption provided the total number between them does not exceed 4.

The complete formula looks something like this:

Net Taxable Compensation = Total Taxable Compensation – exemptions (Personal + Additional)

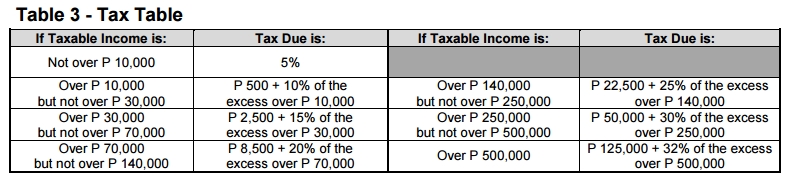

Once you have your Net Taxable Compensation, you can then look at this table to see how much you should have been taxed for the entire year:

TAX TABLE. Data on the table as of June 2013. Image grabbed from BIR

Look at your Net Taxable Compensation and find which bracket it falls under (i.e. within the range under the “If Taxable Income is:” column). You can then get how much you should be taxed and compare it against how much you were actually taxed for.

Sample computation

To better understand how it will be computed (and if you will or will not get a refund), let’s use the following situation as an example. Remember that all the numbers posted are fictional, and may be affected by things such as overtime pay, absences, leaves, under time, etc.:

Juan dela Cruz is a single man without any qualified dependents whose annual compensation is as follows:

- Basic Monthly Salary: P15,000 x 12 = P180,000

- SSS/Philhealth/Pag-Ibig monthly contribution: P832.50 x 12 = P9,990

- 13th month pay for the year: P15,000

- Withholding Tax (January – December 2016): P1,541.83 x 12 = P18,501.96

From here, we compute for his Total Taxable Compensation:

Total Taxable Compensation = P180,000 – P9,990 = P170,010

Net Taxable Compensation = P170,010 – P50,000 (since his tax status is Single) = P120,010

Looking at the table, his Taxable Income falls within the P70,000 – P140,000 bracket, meaning he should be taxed P8,500 plus 20% of the excess over P70,000.

Tax Due = P8,500 + [(P120,010 – P70,000) x 20%] = P18,502.00

Comparing his Tax Due with his Withholding Tax from January to December 2016, we see that he nearly broke even: a four-centavo difference between his Tax Due and Withholding Tax for the year. That will usually be included in his first paycheck for January 2017.

This was a lengthy article, but we hope it helped you understand tax refunds in the Philippines.

Source: #AskTheTaxWhiz (Rappler), Income Tax Calculator (Rappler), PayrollHero, BIR