Expats’ Guide to 13th Month Pay and Christmas Bonus

Christmas is the most wonderful time of the year, especially for salaried employees. Not only is it the time of the year when employees get to relax and spend time with their families, it’s also the time when their pockets tend to contain the most cash.

December is the time when salaried employees get their long-awaited 13th Month Pay and Christmas Bonus. These monetary benefits are highly anticipated as employees usually spend it on preparations for Christmas and New Year’s Eve.

There are, however, people still confused with these two monetary benefits, either with its implementation or the actual terms used. Here’s our guide to understanding what these two statutory benefits are:

Know the difference

One of the most frequently asked questions is the difference between an employee’s 13th month pay and his/her Christmas bonus. Foreign employers are usually the ones asking, and the confusion comes from when they are paid: both are given during December.

To settle the score, an employee’s Christmas bonus is a form of monetary benefit that’s voluntarily given by the company he/she works for. An employee’s 13th month pay, on the other hand, is something covered by law: Presidential Decree (PD) No. 851, to be exact.

This means one thing: an employer is required to give an employee his/her 13th month pay, but not necessarily a Christmas bonus.

Now that you know what the difference is, let’s talk more about 13th month pay.

Why is it given?

PD 851 was enacted on December 16, 1975 by then-President Ferdinand Marcos, Sr. to protect the level of real wages in the country from worldwide inflation, as well as to allow anyone earning not more than P1,000 a month (for the record, P1,000 back then is equal to just under P38,000 today). It has since been raised to P82,000 thanks to Republic Act No. 10653.

It’s also his way of showing “concern for the plight of the working masses so they may properly celebrate Christmas and New Year.”

Who can receive it and when?

This one is fairly straightforward. Only a rank-and-file employee who has worked with a company for at least one month during a calendar year should receive a 13th month pay no later than December 24 of that same year, regardless of employment status.

Rank-and-file employees, as defined in Book Five of the Philippine Labor Code, are those who cannot make and/or execute management policies, hire, transfer, suspend, lay-off, recall, discharge, assign, or discipline employees, or effectively recommend such managerial actions.

Resignation or termination does not disqualify you from receiving your 13th month pay, though it will be computed based on how many months you worked for the company starting from the beginning of the calendar year until your last day at work.

How much is it?

An employee’s 13th month pay should not be less than 1/12th of their total basic salary earned for a calendar year. It is also non-taxable as long as it falls under P82,000, similar to one’s Christmas bonus and other productivity incentives.

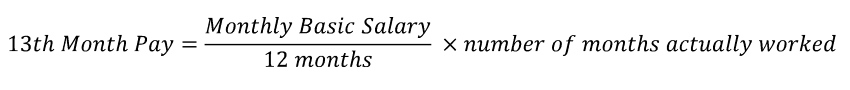

The Handbook on Workers’ Statutory Monetary Benefits (2016 Edition) from the Department of Labor and Employment gives us a way of computing for your 13th month pay:

A MONTH’S WORK. That’s how much your 13th month pay is usually worth.

This is by far the simplest way of looking at it, though the handbook says it’s your total basic annual salary divided by 12 months, including any changes to your basic monthly salary (promotions, raise, etc.).

A HANDY GUIDE. For those of us who don’t fancy reading as much. Image grabbed from Department of Labor and Employment

These are just the basics of 13th month pay. For the complete set of rules and regulations, please read the Handbook on Workers’ Statutory Monetary Benefits and search for “Thirteenth Month Pay”.

Source: Handbook on Workers’ Statutory Monetary Benefits